Property owners are entitled to a cap on the amount of property taxes over 1 percent of the gross assessed value for homestead properties, 2 percent for other residential and agricultural land, and 3 percent for other real and personal property. However, it is important to understand that local government budgets still determine property tax rates in your area. The caps ensure that a property owner does not pay more than a fixed percent of the property's gross assessed value in taxes, but the caps do not change the local tax rate. So let's review how a tax bill is calculated and what is shown on your bill.

Table 1: Summary of Your Taxes

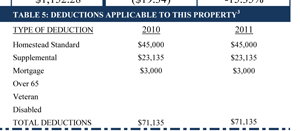

Property tax deductions are applied to the gross assessed value of a property to determine the taxable value of the property, also known as the "net assessed value." The sum total of all deductions will be shown on Line 2a. These deductions are itemized in Table 5, which we will discuss a bit later. The resulting "net assessed value of property" found on Line 3 is the amount on which the taxes are calculated.

![]()

Next, the net assessed value of the property is multiplied by the local tax rate to obtain the gross tax liability. As mentioned previously, the caps do not change the local tax rate. All property in a taxing district will be taxed at the same local rate.

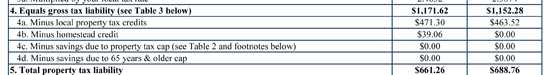

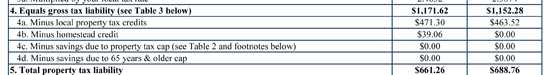

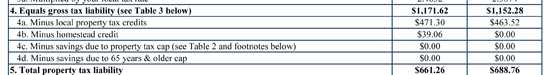

Any available local credits are now applied to the property tax bill to reduce the tax liability. Some counties offer local credits to property owners using local option income tax revenue. Depending on the county, these credits may be offered to all property owners, only residential property owners or only homestead property owners.

The amounts of the local and state credits are calculated by applying a percentage reduction to the gross tax liability (Line 4) of the eligible property. These reductions are shown on Line 4a and Line 4b.

The next step in the calculation of your property tax bill involves the application of the appropriate cap. Remember, homestead taxes are capped at 1 percent of gross assessed value, other residential and agricultural land property at 2 percent, and all other property at 3 percent. If the taxes due after applying credits are still over the cap, the taxpayer receives a third credit to bring the tax liability down to the cap. In the provided example, the gross tax liability is $1,152.28. The local and state credits reduce this liability to $688.76. This amount must be compared against the cap amount, which is shown in Table 2 of the tax bill (more on this later).

In this example, the taxes of $688.76 are less than the allowable $1,296, so no credit is necessary (Line 4c) to bring the taxes due down to the cap.

A final credit may be applied for eligible senior citizens. Taxpayers receiving this credit do not pay more than 2 percent above what was due the previous year. If the taxes due after the credits on Lines 4a, 4b, and 4c result in more than a 2 percent annual increase, a fourth credit is applied to bring the taxes due down to the allowable amount.

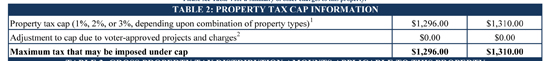

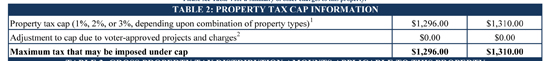

Table 2: Property Tax Cap Information

Table 2 shows you the amount of your property tax cap. The first line shows the cap amount based on the 1 percent, 2 percent, and 3 percent thresholds. If the property is split into separate classifications (see Table 1), this amount will be the combined caps for the separate classes of property. The second line lists any adjustments for things exempt from the cap. If the majority of voters in your district have approved a referendum to allow a building project or to allow your school district extra operating funds, those charges are exempt from the cap. The third line of Table 2 shows the maximum amount of taxes you can be charged.

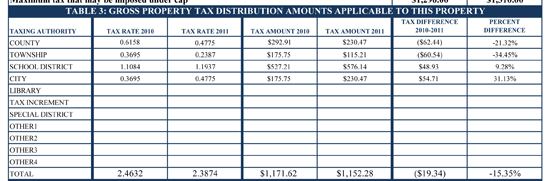

Table 3: Gross Property Tax Distribution Amounts Applicable to this Property

Although you only pay one property tax bill to the County Treasurer, your property tax payment funds many different governments: your county, your city, your school system, your township, and other local governments. Table 3 breaks down your total taxes (before credits) to show how much of your payment goes to each unit of government. The first two columns list the tax rates of each unit of government. These add up to the total tax rate in Table 1, Line 3a. The second two columns list the actual dollars that go to each unit of government. This adds up to the amount found on Table 1, Line 4. Finally, the last two columns show how much the tax amount increased or decreased from the previous year.

Table 4: Other Charges to this Property

Other charges, such as special assessments for ditches, are itemized in Table 4.

Table 5: Deductions Applicable to this Property

Properties often receive multiple deductions, which lower the taxable assessed value of the property. These deductions are itemized on Table 5.

Additional information regarding property tax deductions is available HERE.

Tax Bill 102

Now that you understand how to read a TS-1 tax comparison statement, let's look at a more complicated example:

THE FACTS About Joe's Property

- Consists of a dwelling, one garage, and five acres of real estate.

- Three of the five acres are agricultural land.

- Joe has applied for and meets all eligibility requirements to receive the homestead and mortgage deductions.

- Local tax rate equals 4.000%.

- A referendum project was approved last year, so 1.000% of his local tax rate is exempt from the caps.

- Homestead portion of the property (the dwelling, garage, and one acre of non-agricultural real estate) is valued at $200,000.

- Three acres of agricultural land are valued at $20,000.

- Additional non-agricultural land acre is valued at $10,000.

- In this county, a portion of the local option income tax has been allocated for homestead credits. The local homestead credit rate is 2.000%.

- The State homestead credit rate is 3.000%.

Joe's property tax bill will be calculated in three separate sections for each type of property he owns (homestead, agricultural land, and other property), and the calculations combined on his TS-1 tax comparison statement.

Homestead Portion of Joe's Property | ||

|---|---|---|

| Description | Calculation | TS-1 Location |

| Gross Assessed Value | $200,000 | Line 1a |

| Homestead Standard Deduction | ($45,000) | Line 2a |

| Homestead Supplemental Deduction | ($54,250) | Line 2a |

| Net Assessed Value | $97,750 | Line 3 |

| Multiply by Local Tax Rate | $3,910 | Line 3a |

| Minus Local Credit | ($78.20) | Line 4a |

| Minus State Credit | ($117.30) | Line 4b |

| Tax Liability Before Application of Cap Credits | $4,914.50 | Not shown on TS-1 |

Agricultural Land Portion of Joe's Property | ||

|---|---|---|

| Description | Calculation | TS-1 Location |

| Gross Assessed Value | $20,000 | Line 1b |

| Net Assessed Value | $20,000 | Line 3 |

| Multiply by Local Tax Rate | $800 | Line 3a |

| Tax Liability Before Application of Cap Credits | $800 | Not shown on TS-1 |

Other Property Portion of Joe's Property | ||

|---|---|---|

| Description | Calculation | TS-1 Location |

| Gross Assessed Value | $10,000 | Line 1c |

| Net Assessed Value | $10,000 | Line 3 |

| Multiply by Local Tax Rate | $400 | Line 3a |

| Tax Liability Before Application of Cap Credits | $400 | Not shown on TS-1 |

The total tax liability for Joe's property (before the application of any cap credits) is $4,914.50.

Now it is time to determine the maximum allowable tax liability under the caps (Table 2). The homestead portion of the property - gross assessed value of $200,000 - is capped at 1 percent or $2,000 in this example. The agricultural land - gross assessed value of $20,000 - is capped at 2 percent or $400 in this example. The additional acre - gross assessed value of $10,000 - is capped at 3 percent or $300. This equates to a total unadjusted cap of $2,700.

Because a referendum project was approved, the cap maximum has to be adjusted to account for the 1.000% (in this example) of the tax rate which is outside of the caps. Adjustments to the caps are calculated based on the net assessed value, not the gross assessed value, because this indicates which portion of the tax liability - as determined by multiplying the net assessed value by the local tax rate - should be outside of the caps. The adjusted cap for the homestead portion of Joe's property - net assessed value of $97,750 - is $2,977.50 ($2,000 + $97,750*0.01). The adjusted cap for the agricultural land portion of Joe's property is $600 ($400 + $20,000*0.01). The adjusted cap for the extra acre of land is $400 ($300 + $10,000*0.01).

| Property Tax Cap | $2,700 | Table 2 |

| Adjustment to Cap | $1,277.50 | Table 2 |

| Maximum Tax Under Cap | $3,977.50 | Table 2 |

Now, as you can see, the maximum that may be imposed under the caps, as indicated in Table 2, is lower than the tax liability we calculated previously of $4,914.50. However, a credit of $937 should not simply be applied to bring the tax liability down to the maximum. To determine how much circuit breaker credit should be applied to this property, each piece should again be considered separately.

The maximum tax liability that may be imposed on the homestead portion is $2,977.50. The actual tax liability is $3,714.50 (after state and local credits are applied), so the cap credit amount is $737. The maximum tax liability that may be imposed on the agricultural land portion is $600. The actual tax liability is $800, so an additional $200 cap credit will be applied. The maximum tax liability that may be imposed on the extra acre is $400. The actual tax liability is $400, so no additional cap credit will be applied.

| Tax Liability Before Application of Cap Credits | $4,914.50 | Not Shown on TS-1 |

| Minus Savings Due to Cap | $1,337 | Line 4c |

| Total Tax Liability | $3,577.50 | Line 5 |

The final total tax liability is actually less than the maximum indicated in Table 2 because the cap credits are calculated individually based on the property type - offering Joe (and all taxpayers) more property tax relief.