Updated 4/23/2024:

As a part of the annual routine adjustment process, each of INPRS’s Target Date Funds (TDFs) will be updated on or around April 18, 2024, according to the Funds' objectives to align with each retirement year.

This yearly rolldown aligns investment returns and risks with the potential retirement plans of its investors, like you. INPRS members whose plans allow the TDFs investment options were informed of these changes via email.

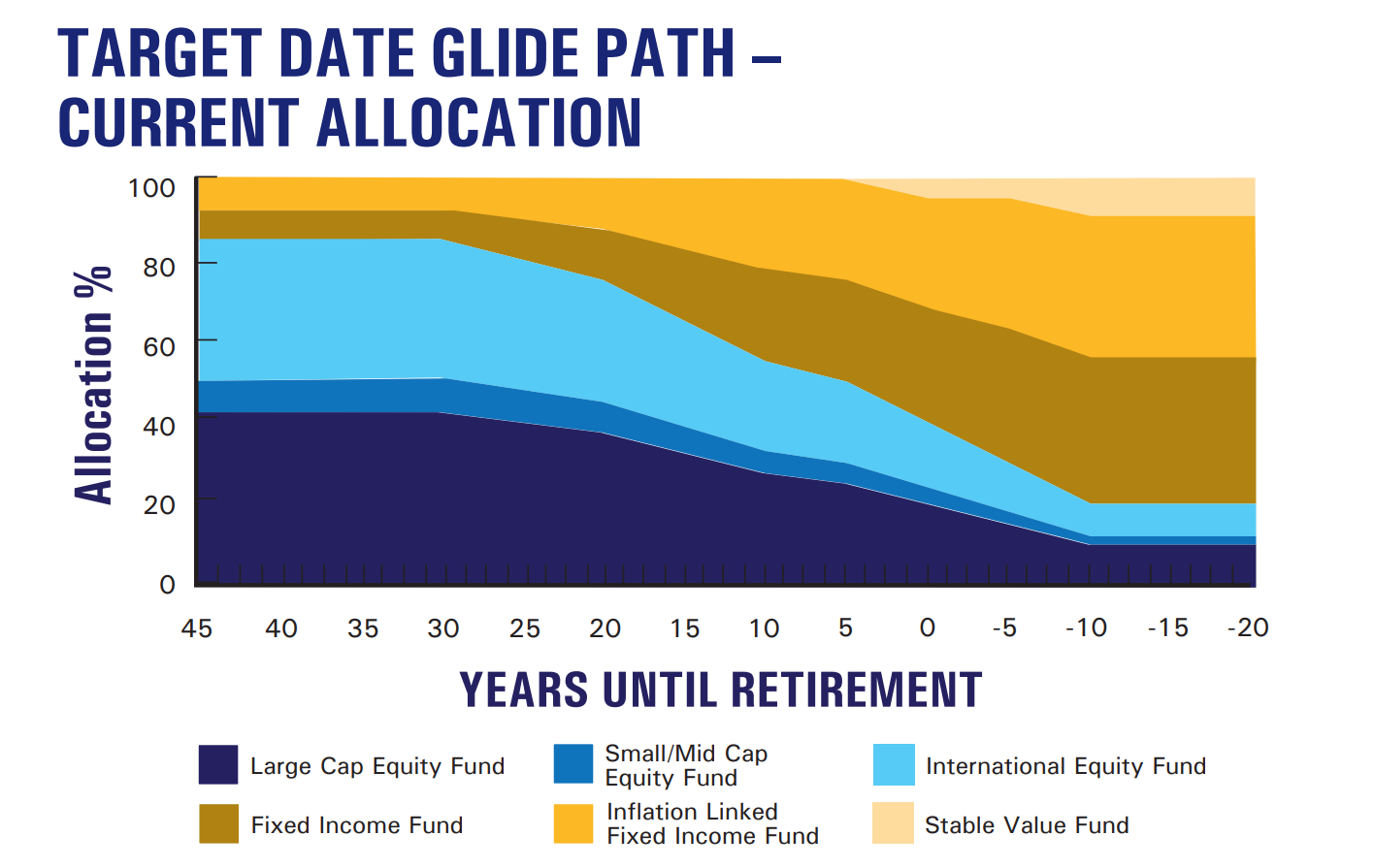

Labeled with the approximate date a member may be expecting to retire or may begin withdrawing benefits, these funds are designed to stick with you as you near retirement. TDFs are a part of INPRS’s lineup of investment options that automatically change the asset allocation for you by offering a bundled mix of professionally managed investments. The TDFs are diversified investments that adjust their risk levels automatically to become more conservative as you near retirement.

INPRS’s TDFs use a “through retirement” glide path construction designed to earn positive returns, reduce stock exposure, and increase bond exposure until 10 years after the assumed retirement date. As you approach your target retirement year the mix of stocks and bonds within each TDF becomes more conservative. INPRS defaults the TDF to align with an assumed retirement age of 65. However, you should review your financial picture and make investment decisions that satisfy you and your family’s retirement strategy. As with any investment, risks are involved, and the principal value of the fund is not guaranteed at any time.

For more details, please review the Target Date Fund fact sheet. Additional information on TDFs and investments can be found here.