Frequently Asked Questions

Below are answers to common questions received about Indiana’s Home Energy Rebate Programs, known as the Indiana Energy Saver Program, which will be administered through the Office of Energy Development (OED). For additional questions, please reach out to Indiana OED at rebates@oed.in.gov.

Program Overview

- What are the Home Energy Rebate programs?

The Home Energy Rebate programs were authorized by legislation signed into federal law on August 16, 2022. The programs consist of the Home Efficiency Rebate Program (HOMES) and the Home Appliance Program (HEAR). Both programs are administered through the U.S. Department of Energy and implemented by states, territories, and tribes.

- How much money will Indiana receive for this program?

Indiana will receive approximately $182 million in total federal formula funds to administer both programs. Exact appropriations can be viewed here.

- What is the difference between the HOMES and HEAR programs?

- The Home Efficiency Rebate program, also known as HOMES, focuses on energy efficiency upgrades and retrofits to residential buildings, both single-family and multi-family dwellings.

- Qualified energy efficiency upgrades that achieve at least 20% in energy savings will be eligible for rebates up to the lesser of $2,000 or 50% of the project cost. Projects that achieve greater energy efficiency savings at 35% or more or occur for a low-income household (less than 80% Area Median Income) are eligible for greater rebates.

- The Home Appliance Rebate program, also known as HEAR, is exclusively for low- and moderate-income households (less than 150% Area Median Income) to purchase high-efficiency equipment. Like the HOMES program, both single-family and multi-family dwellings qualify.

- Maximum rebate amounts are set by the federal legislation and include equipment such as heat pump water heaters, heat pumps for space heating and cooling, stoves, clothes dryers, and certain electrical upgrades like service load centers and electric wiring.

- The Home Efficiency Rebate program, also known as HOMES, focuses on energy efficiency upgrades and retrofits to residential buildings, both single-family and multi-family dwellings.

- When will Indiana’s Home Energy Rebate program launch?

The Indiana Office of Energy Development aims to launch both programs statewide in 2025.

- What is the maximum rebate amount per household?

Individual household rebate amounts will depend on a variety of factors including income level, predicted energy savings, and the type of energy efficiency improvement. There are federal limits as to how much can be invested in a residential building or dwelling unit under each program.

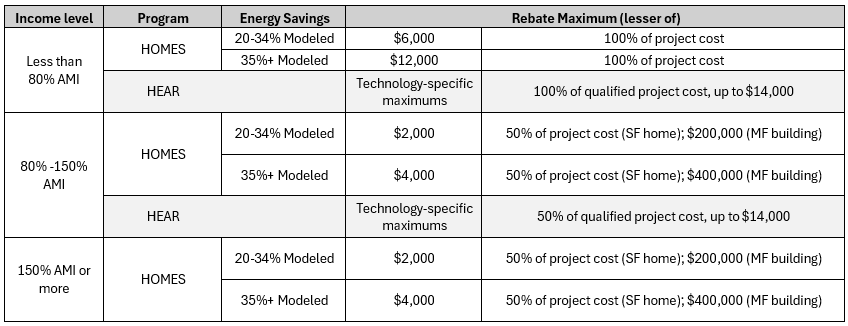

Below is a table that outlines Indiana's maximum rebate amounts. The federal law allows states to increase the HOMES maximum rebate up to 100% of project costs for low-income households (below 80% AMI). OED received approval from DOE to increase the project cost limits under the HOMES program to 100% of project costs up to $6,000 for low-income households that achieve 20-34% energy savings and up to $12,000 for low-income households that achieve greater than 35% energy savings

Maximum allowed rebates under each program are listed in the below table

HEAR Technology-specific maximums

- ENERGY STAR electric heat pump water heater—up to $1,750

- ENERGY STAR electric heat pump for space heating and cooling—up to $8,000

- ENERGY STAR electric heat pump clothes dryer—up to $840

- ENERGY STAR electric stove, cooktop, range, or oven—up to $840

- Electric load service center—up to $4,000

- Electric wiring—up to $2,500

- Insulation, air sealing, and ventilation—up to $1,600

- Will retroactive rebates be provided?

Federal law does not authorize states to offer retroactive rebates under the Home Electrification and Appliance Rebate (HEAR) program.

Federal law allows states to provide rebates under the Home Efficiency Rebate (HOMES) program for projects begun on or after the enactment of the law on August 16th, 2022. However, qualified rebate projects must meet all federal compliance and reporting requirements. Due to the complex nature of the federal regulations associated with this program, OED does not recommend expecting to receive a rebate for equipment or work completed prior to the fully operational start of the state program. To learn more about federal retroactivity requirements, please view DOE's fact sheet.

- How can I receive program updates?

To stay updated on the development of Indiana’s Home Energy Rebate Program, please visit our website, or sign up for email updates.

Program Eligibility

- How do I know if I am eligible for either program?

- The HOMES program is available to all Hoosiers. Those who earn less than 80% of the area median income are eligible for greater rebate amounts

- The HEAR program is exclusive to low- and moderate-income households (those earning less than 150% area median income).

- Single-family and multifamily households are eligible for both programs.

- Renters, building owners, and organizations carrying out projects on behalf of residents are eligible to apply under either program.

- If I already participate in other income-qualified Federal programs, am I automatically eligible?

Households enrolled in any of the federal programs approved for categorical eligibility will be automatically eligible for the related Home Energy Rebate program. Recognized programs for Categorical Eligibility by the U.S. Department of Energy under each program are listed below or can be viewed here.

- HOMES & HEAR (automatically eligible for <80% AMI)

- Recognized programs:

- Low Income Home Energy Assistance Program (LIHEAP)

- Medicaid

- Supplemental Nutrition Assistance Program (SNAP)

- Head Start

- Lifeline Support for Affordable Communications (Lifeline)

- Food Distribution Program on Indian Reservations (FDPIR)

- National School Lunch Program – Free (NSLP)

- Housing Improvement Program (HIP)

- Housing Opportunities for Persons with AIDS

- Supplemental Security Income (SSI)

- Weatherization Assistance Program (WAP) (if 80% AMI is greater than 200% of Federal Poverty Level)

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) (if 80% AMI is greater than 185% of Federal Poverty Level)

- Verified government or non-profit program serving Asset Limited Income Constrained Employed (ALICE) persons or households (eligible ONLY for lower rebate amount) (HEAR only)

- Recognized Multifamily Housing Programs:

- Public Housing (owned and operated by Public Housing Authorities)

- Privately owned multifamily buildings receiving project-based assistance (Section 8, Section 202, Section 811)

- Privately-owned multifamily buildings that house residents receiving tenant-based assistance

- Section 42 Low Income Housing Tax Credit (LIHTC)

- This is not tax advice. Refer to guidance issued by the IRS for detailed information on the rules associated with tax credits.

- Recognized programs:

- HOMES & HEAR (automatically eligible for <80% AMI)

- What is my Area Median Income (AMI)?

Area Median Income varies across the state and is calculated by household size. The U.S. Department of Housing and Urban Development (HUD) reports Area Median Income data for the U.S. each year.

To find the area median income for your area and household size, you can view a table for Indiana counties here. (updated July 29, 2024)

For the most recent data, you can use this tool from HUD or refer to the tables provided by the U.S. Department of Energy.

Program Design

- How do participants receive the rebates?

OED is designing the program to provide rebates instantly in the form of a discount on the product and installation for a qualified project in accordance with program requirements.

- What appliances qualify under the Home Appliance Rebate program?

Below is a list of qualified products and building materials provided in the federal law and outlined in the program requirements.

- ENERGY STAR-certified electric heat pump water heater

- ENERGY STAR-certified electric heat pump for space heating and cooling

- ENERGY STAR-certified electric heat pump clothes dryer

- ENERGY STAR-certified electric stove, cooktop, range, or oven

- electric load service center (i.e., electrical panel)

- electric wiring

- insulation, air sealing, and mechanical ventilation

- How will the Home Energy Rebate program affect the existing electric utility energy efficiency programs?

The Home Energy Rebate programs are distinct from utility efficiency programs. However, collaboration and partnership with utilities are essential for designing successful programs across Indiana. For example, utility data access sharing is crucial to minimize burdens for program applicants and ensure efficient access to the program. Efforts will be made to partner with utilities for utility data access, and additional collaboration opportunities will be explored with the overall goal of maximizing impact and serving as many households as possible.

- Can the rebate program be utilized in conjunction with federal tax credits?

The program can potentially be used alongside tax credits, but we cannot provide specific tax advice. It is incumbent upon the taxpayer to follow IRS rules regarding the applicability of tax credits, especially if any subsidy, rebate, or incentive was received for the upgrade. Specific guidance on tax credits should be sought from the IRS or a tax advisor. IRS resources have comprehensive information on tax credit eligibility and utilization.

Contractors

- I am a contractor who would like to participate in the program. How do I sign up to be a part of the network?

Contractors interested in joining the Indiana Energy Saver Program Qualified Contractor Network can learn more and apply at www.IndianaEnergySaver.com/qualified-contractors.

More questions? Please submit your question to rebates@oed.in.gov.

Updated March 10, 2025