Search for Keywords

For additional compliance guidelines issued through SBOA Bulletins, please see this page.

Preface

Origin - Definition - Nature of Office - Vacancies

Organization of Office, Salary and Expenses, and Fees

- Office Created

- Term of Office

- Qualifications

- Oath

- Endorsement

- Sureties

- Bond

- Amount of Bond and Approval

- Where Filed

- Cost of Bond

- Office Hours and Place

- Appointment of Deputies

- Qualification of Deputy

- First or Chief Deputy

- Bond of Deputies

- Salaries

- Budget Estimates

- Mileage

- Purchases

- Postage - Claim for Purchases

- Record of Hours Worked

- Fees - Costs - Per Diems to be Paid to County General Fund

- Official Court Seal

- Lucrative Office

- Conflict of Interest

- County Board of Elections

- Instruction for County Election Boards

- Compensation for Attendance at Meeting

- Registration of Voters

- Deputy Clerk not Entitled to Additional Compensation

Organization of Office, Salary and Expenses, and Fees - Continued

Duties in General

Official Records and Forms

- Overview

- Form Approval Conditions

- Criminal and Juvenile Entry Docket

- Other Dockets and Records

- Fee Book (Form No. 41)

- Estate Entry Docket - Fee Book - Claim and Allowance Docket, Guardian Docket and Fee Book (Form No. 42)

- Judgment Docket (Form No. 74)

- Court Order Book - Chonological Case Summary and Record of Judgments and Orders

- Clerk's Official Receipt, Clerk's Official Cash Book of Receipts and Disbursements, Daily Balance and Monthly Report

- Monthly Report (Form No. 46CR)

- Report of Collections (Form No. 362)

- Record of Instruments Copied or Proofed (Form No. 138)

- Register of Fees and Funds Held in Trust (Form No. 44)

- Change of Venue Record (Form No. 40)

- Change of Venue Claim of Expense

- Clerk's Record Perpetuation Fund

Use of Records

Filing Complaints Procedural Instructions - Disposition of Papers

Civil Entry Docket: Filing Complaint - Endorsement

- Overview

- Numbering

- Entering

- Issuing Process

- Attorney General to be Served When Actions are Brought Against the State

- Indexing

- Filing Papers

- Bench or Issue Docket

- Filing Docket Sheet

- Appearance by Attorney

- Return of Summons

- Filing Summons

- Entering a Change of Venue Case

- Minutes in Entry Docket

- Order Book - Entries to be Made

- Form of Entry

- Who to Furnish

- Prepare for Final Filing

- Docket Sheet Removed

- Permanent Files

- Entering Judgment

- Minutes Recorded in Entry Docket

- Taxing Costs

- Assemble Papers for Final Filing

- General Indexing Final Files

- Filing Docket Sheet

- Issuing Executions

- Directive Duties

- Value of Entry Docket

The Criminal Entry Docket: Use of Records - General Instructions

Juvenile Records: Use of Records - General Instructions

Probate - Opening Estates - Use of Records - General Instructions

- The Probate Code

- Opening of Estate

- Petition for Probate of Will and Appointment of Personal Representative

- When Letters to be Issued

- Persons Entitled to Domiciliary Letters

- Persons Not Qualified to Serve

- Appointment of Successor Personal Representative

- Special Administrators

- Personal Representative Bond

- Approval of Bonds

- Failure to File Bond - Letters Revoked

- Will to Be Proved

- Proof Before Evidence of Handwriting Admitted

- Proof Required for Probate and Grant of Letters

- Certificate of Probate

- Foreign Wills

- Entering in Records

- Fee

- Election to Take Against Will

- Revocation of Probate of Will - Clerk's Duty

- Will Contest - Bond Approved by Clerk

- When to Enter Proceedings

- Probate Records

- Estate Entry - Claim and Allowance Docket - Fee Book (Form No. 42)

- Entering in Docket

- Endorsement of Probate

- Administration of Oaths

- Issue Letters

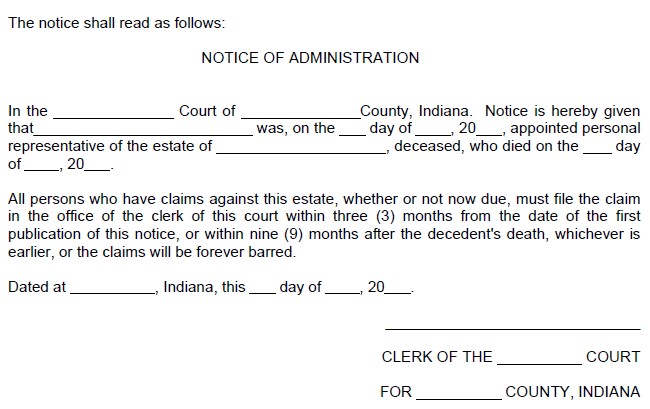

- Notice of Administration [IC 29-1-7-7]

- Service of Notice

Adoptions - Use of Records - General Instructions

Guardianship - Use of Records - General Instructions

- Overview

- When Letters of Guardianship are Issued [IC 29-3-7-3]

- Temporary Guardian

- Considerations for Appointment of Guardian

- Property of Incapacitated Person not in Excess of $10,000

- Transfer of Guardianship

- Costs Upon Transfer

- Inventory of Guardianship Property

- Claim Against Guardianship

- Petition to Compromise or Settle Claim

- Foreign Guardians - Property Located in Indiana - Powers

- Notice of Petition and Hearing

- Where to Enter

- Taxing Costs

- Entries in Guardian Docket

- Filing and Entering as a Civil Matter

- Transferring to Guardian Docket

- Transferring Costs from Civil to Guardian Docket

- Costs - Proceedings for Adjudication of Competency

Support

- Support Defined

- Different from Other Trust Items

- Clerk to Comply with Court Order

- Accepting Personal Checks

- Delivering Checks

- Liability for Support of Parents

- Children Born Out of Wedlock - Voluntary Petition to Establish Paternity - Provision for Support

- Maintenance and Support Orders - Clerk's Fee

- Transfer of Proceedings of Support Order

- Application of Act

Change of Venue Procedures - Change of Venue Record (Form No. 40)

Change of Venue Claim For Expense

- Prepare Claim

- Contents

- File with Auditor

- Clerk's Per Diem

- Per Diem of Special Judge - Not Included as Expense

- Report of Payment

- Chargeable Items of Expense

- Trial Defined

- One Per Diem Per Day

- Change of Venue Cases not to be Docketed Unless Fee Accompanies Transcript

- Change of Venue - Certifying Unpaid Costs

- Change of Venue - Collections and Payment of Costs

- Change of Venue - Contents of Receipt

- Change of Venue - Disposition of Costs

- Change of Venue - Fee Required Upon Change of Venue

- Change of Venue - Notation on Dockets

- Change of Venue - Payment of Costs - By Whom Accepted

- Change of Venue - Posting by Receiving Clerk

- Change of Venue - Fee to Accompany Transcript

- Change of Venue - Receipt to Accompany Transcript

- Change of Venue - Clerk to Prepare Transcript

- Change of Venue in Causes Reversed by the Supreme and Appellate Courts and Remanded to the Lower Court for a New Trial

- Transcript on Change of Venue - Money to Accompany

Receiving Money - Entering in Docket of Original Entry - Taxing Costs - Schedule of Fees to be Taxed by Clerks

- Overview

- Determine Purpose

- Entering Receipts in Docket

- Trust Items

- Distribution of Estate Money

- Transfer Amounts to Individuals in Register of Trust

- Entering Money in Payment of Judgments

- Disbursing

- Releases

- Transcripts to Bind Real Estate

- Department of Revenue and Department of Workforce Development Warrants

- Writing Official Receipt

- Value and Use of Receipt

- Disbursement Entries

- Posting Tables of Fees

- Taxing Costs

- Statutory Court Cost Fees to be Charged Circuit, Superior, Probate and Municipal Courts

- Document Fees

- Licenses

- Miscellaneous Fees

- County User Fees

- State User Fees

- Supplemental Public Defender Services Fund

- Bail (10% Cash Bonds) - Administrative Fee

- Costs and Fees

- Appeal from City Court and Town Court

- Appeal by Prisoner

- Bail and Bail Procedures

- Pretrial Services Fee

- Bail Agents - Forfeited Bonds - Duty of Clerk

General Court Cost Provisions - Criminal Actions

- Criminal Actions - Costs

- Hearing to Determine Indigency

- Default in Payment of Costs

- State to Pay Costs of Trial of Offenses Committed by Prison Inmates

- Fines or Penalty in Addition to Costs

- Costs - Other - When Required

- Fee Bills - Collection of Costs

- Fee Bills - Issuance and Collection

- Fee - When Payable

- Filing Fee Not Required for Petition for Reinstatement

- Fines and Forfeitures - Remission of

General Court Cost Provisions - Civil Actions

Miscellaneous General Court Cost Provisions

- Prepayment When Not Required

- Court Cost Fees - Infractions

- Change of Venue Court Cost Fee

- Publication Requirements

- Juvenile Court - Pregnant Minors

- Nonresident Motorist - Service of Process Upon Secretary of State - Fee

- Paternity

- Statement with Remittance - Change of Venue

- Trusts - Public and Benevolent

- Vehicle License - Additional Excise Tax Judgments

- Overweight Vehicles - Fines and Penalties - Impoundment and Sale

- Highway Worksite Zone Judgments

- Witness Fees

- Jury Fees

- Clerk to Forward Claims

- Punitive Damage Awards

Accounting - Posting Records - Settlement with the County - Closing the Books - Reconciling Depository Balances

- Reconciling Cash with Receipts at the Close of the Day

- Posting the Cash Book of Receipts and Disbursements (Form No. 27A)

- Disbursements

- Add Columns - Prove Totals

- Posting Items of Trust

- Clerk's Cash Book and Daily Balance Record (Form No. 46)

- Cash Book Summary Section

- Daily Cash Reconcilement Section

- Depositing Receipts

- Report to the Auditor and Payment of Fees to the Treasurer

- Closing Books at the End of Each Month

- Court Costs Due State - Semiannual Settlement

- Reconciling the Register of Fees and Funds Held in Trust

- Reconciling the Depository Balance with the Record Balance

- Prepare Monthly Financial Report

- Contents of Report

- Form of Reports

- Preparation of Report

- Filing Report

- Unclaimed or Returned Outstanding Checks

Clerk of Circuit Court

Depositories - Investments

- Designation of Depositories

- Cash Change Fund

- Petty Cash Fund

- Authority for Investments

- General Law

- Interest on Investments

- Service Charges

- Manner of Investing Funds

- Posting Investments to Clerk's Records

- Monthly Report - Form No. 46-CR

- Renewal of Certificates of Deposit

- Investment Cash Management System

Special Programs - Alcohol and Drug Rehabiliation Program

Adult Probation Program

Juvenile Probation Program

Pretrial Diversion Program

Deferral Program

Oaths and Affirmations - To Be Administered Orally

Clerk's Guide

- Recording by Miniature Photographic or Microfilm Process

- Remanded Cases

- Certified Mail

- Open Door and Public Access

- Filing Complaint - Summons

- Lis Pendens Records

- Lis Pendens Record - Written Notice to be Filed by Sheriff or Coroner

- Lis Pendens Record of Dismissals and Satisfaction, Lien or Attachments to be Indexed

- Satisfaction of Lien

- Lis Pendens Record - Dismissal or Satisfaction of Attachment - Certificate

- Dismissal or Satisfaction of Attachment - Certificate - Fee

- Change of Venue - Clerk Striking

- Partition of Real Estate - Transcript

- Transcripts of Records

- Execution and Fee Bill

- Execution not Issued After Ten Years

- Execution May Issue on Sunday

- Execution Docket

- Stay of Execution - Bail

- Clerk to Notify Sheriff

- Expiration of Stay - Joint Execution Shall Issue

- Contempt Proceedings - (Child Support) - Bail or Escrow

- Order of Attachment Issued by Clerk - Approval of Bond

- Ejectments - Affidavits for Possession - Clerk's Order to Seize

- Quiet TItle Proceedings - Notice by Clerk

- Recording Decree in the Recorder's Office

- Receiverships - Record of Statements

- Replevin Action

- Order for Delivery

- Births - Proceedings to Establish Time and Place

Clerk's Guide - Continued

- Births - Notice to be Given

- Birth Certificates Record to be Kept by Clerk

- Dismissal for Failure to Prosecute

- Grand Juries

- Oath of Attorneys - Attorney List

- Certificate of Authority or Acknowledgement - Fee

- Tender of Money Refused

- Failure to Pay Over Fees Collected

- Witnesses for Grand Jury

- Indictment - Duty of Clerk

- Recognizance Filed With and Recorded by Clerk

- Recognizance - Recording a Lien - Real Estate in Other Counties - Release of Liens - Fees of Clerk - Judgement Upon Forfeiture

- Fines or Costs - Default

- Official Bonds Approved by Clerk

- New Bond - Notice by Clerk

- Administration of Oath

- Compensation - Division of Penalty

- Session Laws - Receipt by Clerk - Distribution

- Unclaimed Property - Report to Attorney General

- Delivery of Unclaimed Property to Attorney General

- Successor to Receive Books, Records and Papers

- Department of Workforce Development (DWD) Warrants

- Gross Income Tax Warrants - Clerk to Enter

- Distress Sales (Going out of Business Sales) - License

- Distress Sales - License Fee

- County Commission on Public Records - Created

- County Commission on Public Records - Duties

- Railroad Police

- Handwritten Records

- Attorney Lien

Clerk's Guide - Continued

- Official's Bonds

- City and Municipal Court Judges

- Acting Township Trustee

- Revocation and Suspension of License - Reporting

- Notice of Conviction - Motor Vehicle Owners

- Report of Judgement

- Change of Venue - Appeal

- Judicial Review

- Reorganizations of Schools - Elections - Petitions

- Eminent Domain

- Eminent Domain - Execute Deed

- Eminent Domain - Payment of Damages to One or More Defendants

- Eminent Domain Payment of Damages - Possession of Property

- When Filing Fee is Required

- Direct Deposit of Compensation by Auditor

- Delinquent Tax Judgements

- Setting Aside Tax Judgment - Grounds

- Satisfaction of Tax Judgment

- Title IV-D Incentive Payments

- Jury Fees

- Jury Claims