Many retention and disposition instructions on county/local office records retention schedules include requirements to TRANSFER or DESTROY/DELETE records "after receipt of State Board of Accounts Audit Report and satisfaction of unsettled charges."

Here's how to verify that your office has fulfilled that requirement for any given set of records:

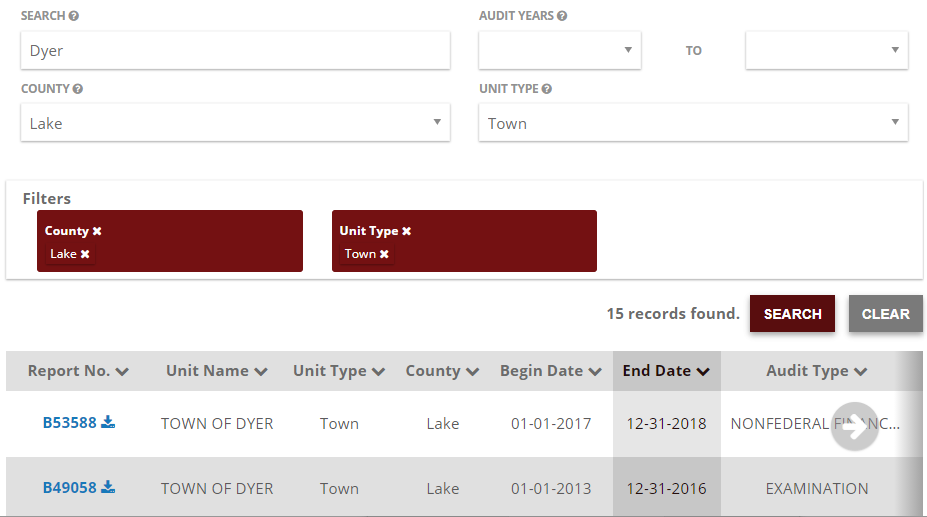

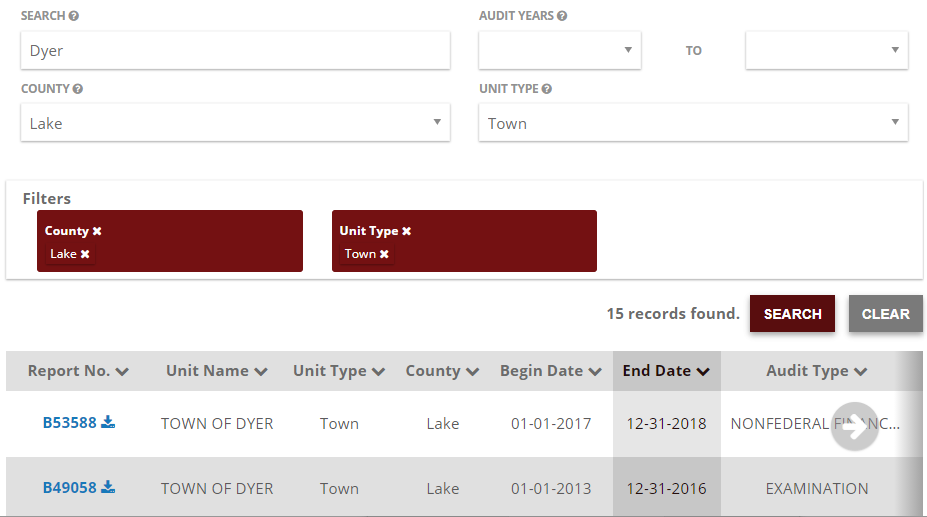

Visit the State Board of Accounts Audit Report Database. In the "County" text box, choose the correct county. In the "UNIT TYPE" drop-down box, choose the correct unit type for your office. (If your unit type isn't listed, just choose COUNTY.) If you still see other entities besides yours in the list of records, type a unique word from your office's name in the SEARCH box. Leave everything else blank. Click the SEARCH button. In the results, click the arrow next to "End Date" to sort by that column. Click the same arrow again to bring the most recent to the top. Find the most recent End Date. If your records date is ON OR BEFORE that End Date, you're good to go!

You don't have to prove that a specific record or file was examined by the auditors; you just have to prove that it could have been, by verifying that an Audit Report has been published since the time when the last information was added to the record. | Audit Report Filings

|