As of Jan. 1, 2024, the tax cap for wholesale cigars is $1.00 each.

INTIME filers will report eligible cigars on the “Totals” screen of Form OTP-M.

Bulk filers will report through the OTP-M dashboard. Select “Report cigars over the tax cap” and enter the number of cigars capped at $1.00.

You must report before filing your return. Be sure you are reporting for the correct tax period.

To comply with legislative changes effective July 1, 2022, the Indiana Department of Revenue (DOR) implemented changes to both Cigarette (Indiana Code (IC) 6-7-1) and Other Tobacco Products (IC 6-7-2, IC 6-7-4) reporting.

DOR has updated Other Tobacco Products (OTP) tax reporting to include Alternative Nicotine Products and Closed System Cartridges. The Indiana OTP-M monthly tax return has been revised to require additional information for a newly added column, “C,” which is for Closed System Cartridges

Cigarette and Other Tobacco Products tax reporting should be done through INTIME, which offers tax account management, return filing and amendments (for businesses and corporations only), the ability to make payments, and respond to correspondence. INTIME user guides are available.

Cigarette Stamp Ordering Process Update

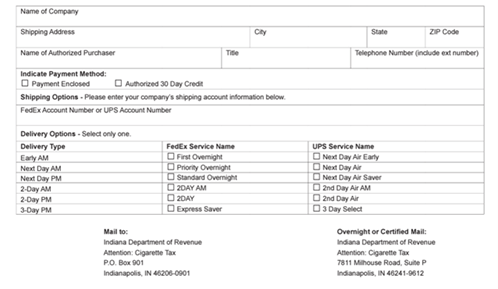

Beginning Jan. 1, 2024, new UPS or FedEx delivery options for Cigarette tax stamps will be available when ordering via INTIME or when using Form CT-4A (State Form 46862). Customers will need to provide their shipping account information when placing an order.

The following information is required when ordering Cigarette tax stamps via INTIME as of Jan. 1, 2024:

- Provide FedEx or UPS account number

- Select FedEx or UPS service

- Provide shipping address information

Similar information will be required when placing an order using Form CT-4A:

Note: Delivery of Cigarette tax stamps via USPS and in-person pickup orders from DOR will no longer be available.

Electronic Filing, Forms, Schemas, and Converter Tools

More information is available below regarding electronic filing, updated forms, schemas, and converter tools for use beginning July 2022. Select the requested electronic filing tax type to expand the section.

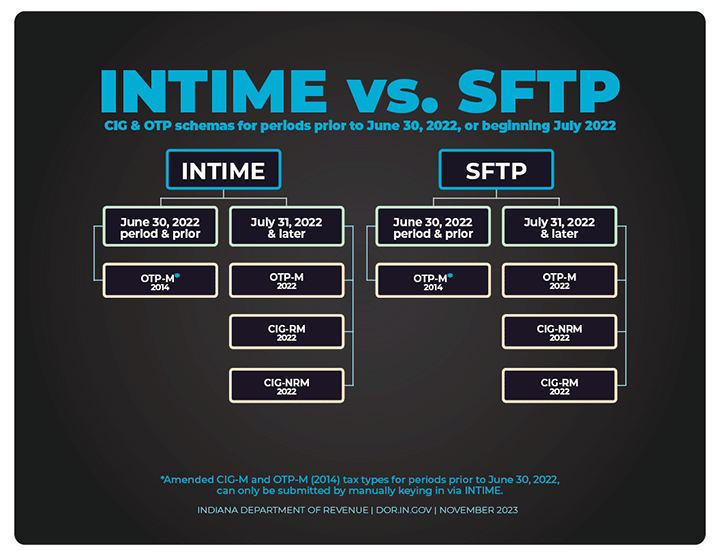

INTIME vs SFTP: Schemas for Cigarette and Other Tobacco Products

Refer to the following flowchart to determine which schema to use when filing Cigarette and Other Tobacco Products via INTIME or SFTP for periods prior to June 30, 2022, or as of July 31, 2022.

Contact Us

For specific questions about CIG, OPT (ENDS), and eCIG tax accounts, use INTIME’s secure messaging to contact DOR Customer Service so that they can view your account and assist you more efficiently.

For more information about Cigarette, E-Cigarette, ENDS, or Other Tobacco Products excise taxes, email DOR’s Special Tax Division or call 317-615-2710.

For more information about the technical requirements for submitting files, email DOR or leave a message at 317-233-5656.