This page provides information regarding the electronic filing of Withholding income tax, answers to frequently asked questions (FAQs), as well as validation rules and common errors.

Withholding Bulk Filing via INTIME and SFTP

The following information is for customers who bulk file withholding income tax returns (WH-1/WH-3) via INTIME or SFTP to provide answers to common errors and guidance on validation rules.

New validation rules are in effect as of Oct. 18, 2023:

Notice for Withholding Bulk Filing Customers: New Validation Rules for EFW2 and 1220 File Formats *NEW*

Updated Business Rules:

- 1220 Flat File Business Rules

- EFW2 Flat File Business Rules

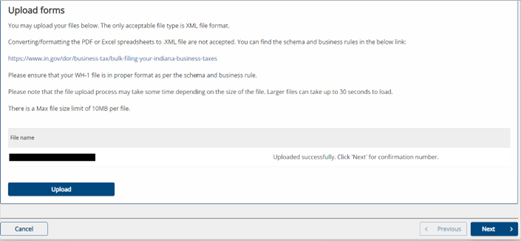

- WH-1 XML Business Rules

- WH-3 XML Business Rules

Additional Resources for Bulk Filing Indiana Taxes are also available.

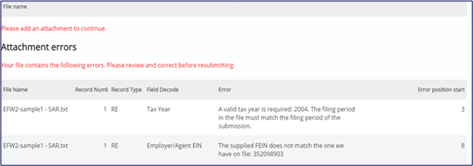

INTIME Withholding File Errors

File-level Errors

A file level error occurs when there is an error in the overall file specification. The following are specific reasons for this generic error:

XML Files Have Two Levels of Validation

- Schema validations

- Business rule validations

If the xml file fails format validations, no business rule validation will occur because DOR will be unable to read the file.

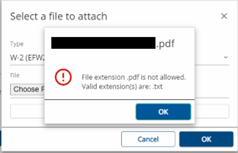

.TXT Files Have Field Value Validations

Flat files (.txt) have field value validations (e.g., line lengths, required records.).

If .txt file fails format validations, no business rule validation will occur because DOR will be unable to read the file.

- EFW2 .txt File with No Carriage Return/Line Feeds (CR/LF) or Record Length Error

- 1220 .txt File with No Carriage Return/Line Feeds (CR/LF) or Record Length Error

- .Txt File Column/Data Level Errors

- EFW2 .txt File Error: No Indiana Withholding Account Established

- 1220 .txt File Error: No Indiana Withholding Account Established

- EFW2 .txt File Error: Invalid State ID Provided

- 1220 .txt File Error: Invalid ID Provided

- EFW2 .txt File Error: Invalid Employer TID Location Provided

SFTP Withholding Errors

XML Files Have Two Levels of Validation

- Schema validations

- Business rule validations

If the xml file fails format validations, no business rule validation will occur because DOR will be unable to read the file.

.TXT Files Have Field Value Validations

Flat files (.txt) have field value validations (e.g., line lengths, required records.).

If .txt file fails format validations, no business rule validation will occur because DOR will be unable to read the file.

Contact Us

For specific questions or concerns, use INTIME’s secure messaging to contact the Electronic Services Team so that they can view your account and assist you more efficiently. Be sure to include a screenshot of any errors with your message.

Electronic Services Team

Indiana Department of Revenue

100 North Senate Avenue, IGC N286

Indianapolis, IN 46204-2253

Bulkfiler@dor.IN.gov