Member update: June 3, 2020

Our new event booking system makes it easy to get the retirement and financial education you need

This week, INPRS launched its new online booking system for all INPRS workshops, counseling sessions, and other events. Our new site features easy, step-by-step registration and allows you to select your desired Retirement and Financial Education Consultant. Please visit this page and register for the event that most interests you. We look forward to meeting you!

Feeling lost in a sea of uncertainty? Take a moment for your emotional and financial health

At this point during the pandemic, we all may be reaching our point of exhaustion. Now, more than ever, it’s important to take a moment to breathe, reassess, and focus on what we can do – not what overwhelms us. To help, check out this article from our annuity provider, MetLife.

We could all use a little more balance

Is balance achievable? Maybe not these days, considering the mountain of things on our plates: working from home, childcare, and social distancing – just to get started. But perhaps seeking out balance is admirable when it comes to your retirement account. Our recordkeeping partners at Voya Financial have some helpful takeaways in this article.

Member update: May 19, 2020

Not retired yet? Find out if market volatility will impact your potential future defined benefit (DB) pension amount

- Your future pension benefit is funded by both employer contributions and investment returns accumulated over many years.

- Your potential future benefit is based on a calculation including both your years of service and average salary. This market volatility will not impact the formula used to calculate the benefit you have earned.

- Members vested in our DB or pension plans have earned their years of service, and INPRS will be ready to pay earned benefits to our vested members, as planned when it's their turn to retire.

I’m already receiving an INPRS benefit, what does this mean to me?

- Market swings have no impact on your pension benefit. It is not at risk. You can expect to receive your monthly retirement benefit as usual and on schedule.

What about funds in my defined contribution (DC) account?

- Remember, investing for retirement is a long-term endeavor.

- It’s important to understand your retirement strategy, especially when you consider your INPRS defined contribution (DC) balance.

- In times of uncertainty, it may not be the best idea to make short-term, reactionary changes. If you are uncertain about what to do, seek advice from a financial advisor.

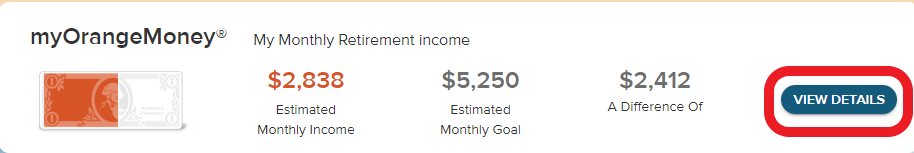

This is a great time to use the online myOrangeMoney® tool to review and plan all your potential retirement income sources. To review your account, please log on to www.myINPRSretirement.org. If you have questions about your account, please call us at (844) GO-INPRS or (844) 464-6777. For investment advice, please contact your trusted financial advisor.

Is it time to revamp your budget? Check out this simple approach and get it done this weekend.

Have you heard of the 50/20/30 budgeting rule? It’s a straightforward way to categorize your spending, giving you a simple budget that allows plenty of room for fun and just enough boundaries to help you keep up with your commitments- both to savings goals and financial obligations. This option is one of many available to you as you revamp your budget and prepare to save for retirement. INPRS encourages you to review all of your options and seek advice from a financial advisor about your situation. Check out the details of this method, here.

The effects of the COVID-19 pandemic will be lasting – especially to our finances

Americans’ approach to day-to-day decisions about where to grab lunch, when to get groceries, and how to bring new things into their homes has been rocked by the current pandemic. Some of these recent behavioral adjustments may change our thinking and actions in the long term. Read more, here.

Retirement education and counseling don’t take a break during social distancing

Since mid-March, INPRS’s retirement and financial education consultants have pivoted to provide safe and socially distant education and counseling to INPRS members like you. We can help you as you prepare for your upcoming retirement or as you seek out more plan information. Our team is ready to meet with you! For appointments and events before June 1, click here. For events on and after June 1, click here.

Member update: May 5, 2020

Register for a webinar with the Social Security Administration on May 12!

Registration is now open for the next webinar with the Social Security Administration. Spaces are limited so register now. Attend and learn how to qualify, get an explanation of benefits, find out about online tools and resources, and get answers to your questions.

Join us on Tuesday, May 12 from 9:30 to 11:30 a.m. Register here.

Get the facts about coronavirus-related distributions

The Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law on March 27, 2020, helping ease some of the financial pressures facing Americans in the wake of COVID-19. If you have been impacted by COVID-19 and meet the eligibility requirements, the Act allows more access to retirement savings. This applies only to members of the following INPRS plans: PERF Hybrid, TRF Hybrid, PERF My Choice, TRF My Choice, and LE DC.

We appreciate this is a challenging situation and you may need access to your retirement savings (defined contribution account), however it’s important to weigh the immediate benefit of taking a plan distribution with the long-term consequences of depleting your retirement savings.

For more information, read here.

We have workshops and one-on-one appointments available

Our retirement and financial education team is ready to serve you. Whether you’re ready to retire soon or just want a better understanding of your retirement benefits, we have an option for you:

- INPRS General Presentation – PERF and TRF Hybrid information via webinar

- PERF/TRF Retirement webinar

- 1:1 appointments by phone

Register for any of these opportunities here.

Member update: Apr. 27, 2020

The Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law on March 27, 2020, helping ease some of the financial pressures facing Americans in the wake of COVID-19. If you have been impacted by COVID-19 and meet the eligibility requirements, the Act allows more access to retirement savings.

We appreciate this is a challenging situation and you may need access to your retirement savings, however it’s important to weigh the immediate benefit of taking a plan distribution with the long-term consequences of depleting your retirement savings.

You satisfy the eligibility requirements to receive benefit relief if you are an individual who experiences one (1) of the following:

- You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

- Your spouse or dependent is diagnosed with such virus or disease by such a test; or

- You experience adverse financial consequences as a result of:

- being quarantined, furloughed or laid off or having work hours reduced due to such virus or disease,

- being unable to work due to lack of child care due to such virus or disease, closing or reducing hours of a business owned or operated by the individual due to such virus or disease; or

- meeting such other factors as may be issued in Treasury guidance.

If you meet one of the eligibility requirements described above, you may be eligible to request coronavirus-related distributions (CRD) from your INPRS defined contribution plan (DC plan).

- You can request a CRD of up to an aggregate amount of $100,000 through December 31, 2020.

- The CRD is not subject to the 10% early withdrawal penalty tax or mandatory federal 20% withholding that otherwise apply to early distributions.

- However, you may be required to pay tax on this distribution when you file your annual tax return. You may elect to have the CRD included in your gross income ratably over three years or the total distribution included as income for 2020. Voya will report your distribution for the 2020 tax year. You should work with your tax advisor in regard to your taxes.

- Please note that $100,000 CRD maximum applies on an individual basis for all of your retirement plans and IRAs. If you take a CRD from another plan or IRA, you are responsible for tracking your limits to ensure that you do not exceed the maximum.

IMPORTANT: In order to receive the coronavirus-related relief you will be required to certify that you satisfy one of the eligibility requirements listed above at the time of the request. For more information or to elect one of these options, please call and speak to one of our member service representatives at (844) GO-INPRS or (844) 464-6777.

Other relief for all members regardless of whether or not you meet the eligibility requirements includes required minimum distributions (RMDs).

Required minimum distributions (RMDs)

- There are no required RMDs for 2020.

- You will receive an additional communication if RMDs are applicable to you.

Please note that neither INPRS nor Voya cannot provide you with tax advice. Prior to taking an action, you should speak with your tax advisor.

Member update: Apr. 21, 2020

Can you predict your future retirement income? Maybe!

Every INPRS member has access to an incredible resource that can help predict how much money they may receive during their retirement years, based on their unique retirement savings situation. This resource, myOrangeMoney®, is located within your secure INPRS account. myOrangeMoney® automatically populates with your INPRS pension and DC balance information and inputs your expected Social Security benefit. You can even add your additional savings outside of INPRS. This tool will help you understand how much you can expect each month based on your current behavior, and you can see how saving more and working longer can impact your future paycheck. Log on to your INPRS account today and try it out!

Get personal attention from one of INPRS’s finest

INPRS’s retirement and financial education specialists can help you understand many aspects of your retirement income. Our talented team can help shed some light on your expected INPRS benefit, savings, and overall financial and savings goals. Register to attend a general presentation! Attendees will get to know how their plan works, how to qualify for INPRS benefits, and how to get the most out of their INPRS membership. We also offer pre-retirement webinars that all members are welcome to attend, even if retirement is several years away. Additionally, we’re able to schedule one-on-one appointments over the phone where members can discuss their personal financial situation, retirement dreams, and ask any questions they like. Register here.

Did you miss the Social Security webinar sign-up?

We had such incredible interest in our upcoming webinar with Social Security that we’ve added another date! Mark May 12, 2020, on your calendar for our next Social Security webinar and look for another email from us in the coming weeks with registration information. Space for this webinar will also be limited.

While you wait, visit the Social Security Administration’s website for other available resources. “Understanding the Benefits” is a great resource to review. Get the PDF here and the audio file here.

Can you time the market?

Do you know the right time to invest? It may feel like there’s a right time to invest, move your money, or even take your money out of an investment – but is there? Our recordkeeping partners, Voya Financial, have provided a helpful guide to help you understand market timing so you can make the best investment decisions for your personal situation. Read on, here.

INPRS quarterly member statements will soon be available

INPRS members with an active defined contribution (DC) account will soon receive their quarterly member statements (QMSs) in the mail or through email notification. These statements will cover the first quarter of 2020’s performance or, Jan. to Mar. 2020. Everyone’s investments are unique, but you may notice some market changes occurring in this quarter due to the worldwide impact of COVID-19. We encourage all INPRS members to carefully review their statements and consider the long-term nature of their INPRS DC account. Depending on their retirement timeline, their DC account may be invested for as long as they are working, and it’s important to consider the long-term nature of investment choices.

For real-time investment performance, members should log on to their accounts here. Members receiving mailed QMSs will also receive our Destination: Retirement newsletter and those receiving emailed notifications will get a link to our electronic copy. PERF, TRF, and LEDC members can click here for their copy. Members in all other funds can click here.

Economic impact payments are on their way

Depending on your filing status, you may have already received your economic impact payment from the Internal Revenue Service through direct deposit. If you have not yet received your payment and are expecting one, reference the “Get My Payment” tool from the IRS. To learn more about eligibility, click here.

Get the INPRS FAQs

Every day, there’s new information surrounding federal action in response to COVID-19, some of which may relate to your INPRS account. To get the facts, view our FAQs.

Member update: Apr. 14, 2020

Considering moving your money?

If recent market movements have you thinking about adjusting your investments, INPRS encourages you to think about the long-term before you make a retirement-altering decision. Our recordkeeping partner, Voya Financial, has provided a helpful guide, “Weathering the storm” to help you consider your options. Check out the guide here.

Limited space available: Social Security presentation

The Indiana Public Retirement System is hosting a special online presentation from the Social Security Administration on April 29 at 10 a.m. ET. Attend and learn how to qualify, get an explanation of benefits, find out about online tools and resources, and get answers to your questions. Register here.

Protect your economic impact payment from scammers

No matter what, scammers seem to find a way to identify opportunities in the midst of a crisis. One opportunity that the Internal Revenue Service is warning consumers of is that of scammers attempting to separate consumers from their economic impact payment. Protect your payment – check out this article from the IRS, complete with expected scams, tips, and facts about how the IRS will and will not communicate with taxpayers.

Do you know who can act for you, if you’re unable to take care of your INPRS account?

In the event you’re unable to take action on your INPRS account yourself, do you know who can do so for you? You can find the information along with the form and the instructions to help you submit it to INPRS here.

The impact of the CARES Act on your INPRS account

The recently-enacted CARES Act has some provisions about retirement accounts you should be familiar with. To help you understand the potential impact on your retirement account with INPRS, view our FAQs.

Get the COVID-19 facts

We know you have news updates, social media posts, and family and friends talking to you regularly about COVID-19 and its impact. Get clarity and the facts directly from the state of Indiana’s update page here and share it with others.

INPRS is online and on the phone, ready to serve you

Our Retirement and Financial Education team is ready to support you on your journey to retirement. Register for a digital workshop or counseling session here.

Member update: Apr. 7, 2020

INPRS to host Social Security presentation online

The Social Security Administration (SSA) will be hosting an online presentation on April 29. Registration is not yet available, so please mark your calendars!

Do you know who can act for you, if you’re unable to take care of your INPRS account?

In the event you’re unable to take action on your INPRS account yourself, do you know who can do so for you? You can find the information along with the form and the instructions to help you submit it to INPRS here.

Keep your information up-to-date

As you’re working from home, be sure to check in with your INPRS account and other important institutions and update your beneficiary information. Doing so will give you and those you love peace of mind, and you can check something off your to-do list! Log on to your account at www.myINPRSretirement.org.

Have questions about economic impact payments?

There’s lots of information circulating about economic impact payments, and it can get confusing. The IRS has posted helpful facts, dates, and resources about payments. Check it out here.

Member update: Mar. 31, 2020

The best way to reach us

The Indiana Public Retirement System (INPRS) is open and ready to serve you. For the most up-to-date information about our member advocate team hours, online access, and how to register for a counseling session, visit this page.

Work with INPRS – online and on the phone

Are you ready to learn more about your retirement benefits or interested in some support as you complete your INPRS retirement application? We’re actively meeting with members online or over the phone and look forward to helping you. Register for a workshop or counseling session here.

How to know who works for INPRS: Keeping your financial information safe

Occasionally INPRS members are contacted by financial sales representatives who may leave the impression they work for or represent INPRS (PERF, TRF, etc.). Here are a few pointers to make sure you and your hard-earned retirement savings remain safe.

- INPRS Retirement Services Consultants are public employees, just like you. They each carry identification. If you have any doubt who they work for, ask to see that identification.

- INPRS Retirement Services Consultants meet with thousands of members each year. You are entitled to as many appointments with an INPRS Retirement Services Consultant as you wish. There is never a charge for these meetings.

- INPRS offers more than 700 workshops each year. You may attend an unlimited number of these INPRS workshops, at no charge.

- You may personally schedule yourself to attend a workshop or appointment via bit.ly/INPRSworkshops or by calling us at (844) GO-INPRS.

- An INPRS Retirement Services Consultant will never ask to meet with you in your home.

- We offer face-to-face workshops and individual counseling sessions where public employees work, such as libraries, colleges, and schools. Only in rare and unusual circumstances would we suggest meeting with you at a coffee shop or restaurant.

- Some INPRS members work with expert, high-quality outside financial services professionals. Ethical financial representatives will never intentionally give you the impression they work for, or represent, INPRS.

Information about market volatility

If you're concerned about recent market volatility, you're not alone. INPRS's recordkeeping partner, Voya Financial, offers some information that may be helpful during this season of market changes. Read on, here.

Member update: Mar. 17, 2020

INPRS's response to the coronavirus: what this means for working members

There’s a lot of movement in the stock market right now and the Indiana Public Retirement System (INPRS) wants you to understand what that means for you, your retirement, and your INPRS account.

- Markets don’t love uncertainty. When there are global issues at play, it’s common to see that reflected in market behavior. Recently, concerns regarding the coronavirus and other global issues have resulted in decreased stock market values.

- While these market changes are concerning, please know that INPRS’s defined benefit (DB) investments are diversified and designed to target a long-term 6.75 percent return over 30 years.

- As part of that diversification, INPRS’s target investment allocation to public equities (the stock market) is just 22 percent.

- Events like the recent market swings are precisely why we are so diversified.

What about funds in my defined contribution (DC) account?

- Remember, investing for retirement is a long-term endeavor.

- It’s important to understand your retirement strategy, especially when you consider your INPRS defined contribution (DC) balance.

- In times of uncertainty, it may not be the best idea to make short-term, reactionary changes.

I’m not retired yet. Will this market volatility impact my potential future defined benefit (DB) pension amount?

- Your future pension benefit is funded by both employer contributions and investment returns accumulated over many years.

- Your potential future benefit is based on a calculation including both your years of service and average salary. This market volatility will not impact the formula used to calculate the benefit you have earned.

- Members vested in our DB or pension plans have earned their years of service, and INPRS will be ready to pay earned benefits to our vested members, as planned, when it's their turn to retire.

I’m already receiving an INPRS benefit, what does this mean to me?

- Market swings have no impact on your pension benefit. It is not at risk. You can expect to receive your monthly retirement benefit as usual and on schedule.

This is a great time to use the online myOrangeMoney® tool to review and plan all your potential retirement income sources. To review your account, please log on to www.myINPRSretirement.org. If you have questions about your account, please call us at (844) GO-INPRS or (844) 464-6777. For investment advice, please contact your trusted financial advisor.

What this means for retirees

There’s a lot of movement in the stock market right now and the Indiana Public Retirement System (INPRS) wants you to understand what that means for you, your retirement, and your INPRS account.

- Markets don’t love uncertainty. When there are global issues at play, it’s common to see that reflected in market behavior. Recently, concerns regarding the coronavirus and other global issues have resulted in decreased stock market values.

- While these market changes are concerning, please know that INPRS’s defined benefit (DB) investments are diversified and designed to target a long-term 6.75 percent return over 30 years.

- As part of that diversification, INPRS’s target investment allocation to public equities (the stock market) is just 22 percent.

- Events like the recent market swings are precisely why we are so diversified.

I’m already receiving an INPRS benefit, what does this mean to me?

- Market swings have no impact on your pension benefit. It is not at risk. You can expect to receive your monthly retirement benefit as usual and on schedule.

I still have money in my defined contribution (DC) account. What about those funds?

- Consider the time period for which you are investing.

- It’s important to understand your retirement strategy, especially when you consider your INPRS defined contribution (DC) balance.

- In times of uncertainty, it may not be the best idea to make short-term, reactionary changes.

To review your account, please log on to www.myINPRSretirement.org. If you have questions about your account, please call us at (844) GO-INPRS or (844) 464-6777. For investment advice, please contact your trusted financial advisor.

Employer Update: June 3, 2020

Chat returns as soon as 6/8

INPRS chat is coming back! Last week, we shared the good news you’ve all been waiting for – soon, it’ll be even easier to get answers to your basic INPRS-related questions. Our team has spent the last few weeks training with our chat tool, so we will be ready to serve you starting as soon as June 8 through this convenient method. When you’re ready to chat, just visit our website. We can’t wait to help you!

Our new event booking system makes it easy to get the retirement and financial education you and your employees need

This week, INPRS launched its new online booking system for all INPRS workshops, counseling sessions, and other events. Our new site features easy, step-by-step registration and allows you to select your desired Retirement and Financial Education Consultant. Please share the link to our new registration site with your employees. We look forward to meeting them.

We could all use a little more balance

Is balance achievable? Maybe not these days, considering the mountain of things on our plates: working from home, childcare, and social distancing – just to get started. But perhaps seeking out balance is admirable when it comes to your retirement account. Our recordkeeping partners at Voya Financial have some helpful takeaways in this article.

Employer update: May 19, 2020

Retirement education and counseling don’t take a break during social distancing

Since mid-March, INPRS’s retirement and financial education consultants have pivoted to provide safe and socially distant education and counseling to INPRS members as they prepare for their upcoming retirement or seek out more plan information. Our team is ready to meet with your employees! Here are some ways you can help your team connect with INPRS.

- Share INPRS’s appointment availability through your regular employee communications channels. Members can register for workshops and one-on-one appointments on our website. For events before June 1, click here. For events on and after June 1, click here.

- Reach out to your retirement and financial education consultant to schedule a webinar just for your employees. Your organization can host the event as an additional benefit for your employees! INPRS will handle the technology, you provide the attendees. Email us to get your event set up.

- Refer employees directly to INPRS. Has an employee come to you with questions about their INPRS benefits and retirement eligibility? Direct them to the experts at INPRS! We’re happy to discuss their personal situation in a confidential one-on-one appointment where we can explore all of their options and address any of their concerns. Members can register here for events before June 1. To register for events on and after June 1, click here.

The effects of the COVID-19 pandemic will be lasting – especially to our finances

Americans’ approach to day-to-day decisions about where to grab lunch, when to get groceries, and how to bring new things into their homes has been rocked by the current pandemic. Some of these recent behavioral adjustments may change our thinking and actions for the long-term. Read more, here.

Endless questions coming your way? We can help!

With so much change going on, we’re guessing that your employees are sending you seemingly endless questions about their retirement benefit, INPRS, and new government actions as we all navigate the pandemic. To help you and your employees, we’ve been actively adding FAQs to our website to help provide some clarity on what impact legislation like the CARES Act has on INPRS members and their benefits as well as what INPRS is doing to be a good steward of Hoosier retirement benefits. Check out our FAQs here and feel free to share them with your employees as questions arise.

Employer update: May 5, 2020

Encourage your employees to attend our workshops and one-on-one appointments

Our retirement and financial education team is ready to serve you and your colleagues. Whether they’re ready to retire soon or just want a better understanding of their retirement benefits, we have an options:

- INPRS General Presentation – PERF and TRF Hybrid information via webinar

- PERF/TRF Retirement webinar

- 1:1 appointments by phone

Register for any of these opportunities here.

Get the facts about coronavirus-related distributions

The Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law on March 27, 2020, helping ease some of the financial pressures facing Americans in the wake of COVID-19. If you have been impacted by COVID-19 and meet the eligibility requirements, the Act allows more access to retirement savings. This applies only to members of the following INPRS plans: PERF Hybrid, TRF Hybrid, PERF My Choice, TRF My Choice, and LEDC.

We appreciate this is a challenging situation and you may need access to your retirement savings (defined contribution account), however it’s important to weigh the immediate benefit of taking a plan distribution with the long-term consequences of depleting your retirement savings.

For more information, read here.

How to handle furloughed and laid-off workers in ERM

As an employer, you need to understand how to treat a laid-off employee versus a furloughed employee within the EPPA system. Do you know what to do? Here’s how you treat those situations.

Employer update: Apr. 27, 2020

Information about CARES Act distributions

We recently emailed INPRS members information about CARES Act defined contribution account distributions. Read more about who’s eligible, how it works, and how to request a distribution. Please share this information with your employees, especially those who have not provided an email address to INPRS. You may also view our FAQs, here.

Employer update: Apr. 21, 2020

Get personal attention from one of INPRS’s finest

INPRS’s retirement and financial education specialists can help you and your employees understand many aspects of their retirement income. Our talented team can help shed some light on members’ expected INPRS benefit, savings, and overall financial and savings goals. Encourage your employees to attend a general presentation. Attendees will get to know how their plan works, how to qualify for INPRS benefits, and how to get the most out of their INPRS membership. We also offer pre-retirement webinars that all members are welcome to attend, even if retirement is several years away. Additionally, we’re able to schedule one-on-one appointments over the phone where members can discuss their personal financial situation, retirement dreams, and ask any questions they like. Register here.

Did you miss the Social Security webinar sign-up?

We had such incredible interest in our upcoming webinar with Social Security that we’ve added another date! Mark May 12, 2020, on your calendar for our next Social Security webinar and look for another email from us in the coming weeks with registration information. Space for this webinar will also be limited.

While you wait, visit the Social Security Administration’s website for other available resources. “Understanding the Benefits” is a great resource to review. Get the PDF here and the audio file here.

Can you time the market?

Do you know the right time to invest? It may feel like there’s a right time to invest, move your money, or even take your money out of an investment, but is there? Our recordkeeping partners, Voya Financial, have provided a helpful guide to help you understand market timing so you can make the best investment decisions for your personal situation. Read on, here.

INPRS quarterly member statements will soon be available

INPRS members with an active defined contribution (DC) account will soon receive their quarterly member statements (QMSs) in the mail or through email notification. These statements will cover the first quarter of 2020’s performance (Jan. to Mar. 2020). Everyone’s investments are unique, but your employees may notice some market changes occurring in this quarter due to the worldwide impact of COVID-19. We encourage all INPRS members to carefully review their statements and consider the long-term nature of their INPRS DC account. Depending on their retirement timeline, their DC account may be invested for as long as they are working and it’s important to consider the long-term nature of investment choices.

For real-time investment performance, members should log on to their accounts here. Mailed QMSs will also receive our Destination: Retirement newsletter and emailed notifications will receive a link to our electronic copy. PERF, TRF, and LEDC members can click here for their copy. Members in all other funds can click here.

Get the INPRS FAQs

Every day, there’s new information surrounding federal action in response to COVID-19, some of which may relate to your INPRS account. To get the facts, view our FAQs.

Employer update: Apr. 14, 2020

Considering moving your money?

If recent market movements have you thinking about adjusting your investments, INPRS encourages you to think about the long-term before you make a retirement-altering decision. Our recordkeeping partner, Voya Financial, has provided a helpful guide, “Weathering the storm” to help you consider your options. Check out the guide here.

The impact of the CARES Act on your INPRS account

The recently-enacted CARES Act has some provisions about retirement accounts you should be familiar with. To help you understand the potential impact on your employees’ (and your) retirement account with INPRS, view our FAQs.

Help your employees protect their economic impact payment from scammers

No matter what, scammers seem to find a way to identify opportunities in the midst of a crisis. One opportunity that the Internal Revenue Service is warning consumers of is that of scammers attempting to separate consumers from their economic impact payment. Help your employees protect their payments. Refer them to this article from the IRS, complete with expected scams, tips, and facts about how the IRS will and will not communicate with taxpayers.

Limited space available: Social Security presentation

The Indiana Public Retirement System is hosting a special online presentation from the Social Security Administration on April 29 at 10 a.m. ET. Attend and learn how to qualify, get an explanation of benefits, find out about online tools and resources, and get answers to your questions. Register here.

Get the COVID-19 facts

We know you have news updates, social media posts, and family and friends talking to you regularly about COVID-19 and its impact. Get clarity and facts directly from the state of Indiana’s update page here and share it with others.

We’re here for you

Our EPPA team is working remotely to continue supporting you as you administer your employees’ retirement submissions. We’re able to help you, as always, but please know that you may have longer call wait times than usual. If your question is one that can wait for a response, please email us at eppa@inprs.in.gov.

Employer update: Apr. 7, 2020

Updates to ERM

INPRS launched its latest ERM enhancement on Mar. 29, and with it came many useful updates. However, one function of the update will result in lost access to ERM if employers do not keep up with member submissions. Effective immediately, all employers with missing members on their rosters after 90 days will be restricted from using ERM for all employee wage and contribution submissions- not just those for missing members. While we all navigate adjusted work schedules and locations, please keep this in mind. If you lose access to ERM due to missing members, please contact EPPA.

INPRS to host Social Security presentation online

The Social Security Administration (SSA) will be hosting an online presentation on April 29. Registration is not yet available, so please mark your calendars!

Do your employees have questions about economic impact payments?

There’s lots of information circulating about economic impact payments, and it can get confusing. The IRS has posted helpful facts, dates, and resources about payments. Check it out here.

Employer update: Mar. 31, 2020

The best way to reach us

The Indiana Public Retirement System (INPRS) is open and ready to serve you and your employees. For the most up-to-date information about our member advocate team hours, online access, and how to register for a counseling session, visit this page.

A reminder for '77 Fund employers

INPRS has temporarily waived the requirement for pulmonary function tests (PFTs) on baseline examinations. Read more, here.

How to know who works for INPRS: A resource for you and your employees

Occasionally INPRS members are contacted by financial sales representatives who may leave the impression they work for or represent INPRS (PERF, TRF, etc.). Here are a few pointers to make sure you and your hard-earned retirement savings remain safe.

- INPRS Retirement Services Consultants are public employees, just like you. They each carry identification. If you have any doubt who they work for, ask to see that identification.

- INPRS Retirement Services Consultants meet with thousands of members each year. You are entitled to as many appointments with an INPRS Retirement Services Consultant as you wish. There is never a charge for these meetings.

- INPRS offers more than 700 workshops each year. You may attend an unlimited number of these INPRS workshops, at no charge.

- You may personally schedule yourself to attend a workshop or appointment via bit.ly/INPRSworkshops or by calling us at (844) GO-INPRS.

- An INPRS Retirement Services Consultant will never ask to meet with you in your home.

- We offer face-to-face workshops and individual counseling sessions where public employees work, such as libraries, colleges, and schools. Only in rare and unusual circumstances would we suggest meeting with you at a coffee shop or restaurant.

- Some INPRS members work with expert, high-quality outside financial services professionals. Ethical financial representatives will never intentionally give you the impression they work for, or represent, INPRS.

Work with INPRS – online and on the phone

Are your employees ready to learn more about their retirement benefits or interested in some support as they complete their INPRS retirement application? We’re actively meeting with members online or over the phone. Send your interested employees here to get registered.

Information about market volatility

If your employees have expressed concerns about recent market volatility, they’re not alone. INPRS’s recordkeeping partner, Voya Financial, offers some information that may be helpful during this season of market changes. Read on, here.

Employer update: Mar. 17, 2020

Here's how you can work with INPRS as we navigate nationwide health concerns

INPRS remains open and is ready to provide excellent service to our employers and members.

INPRS is conducting business as usual with modifications to help do our part to curb the spread of the coronavirus (COVID-19), per the direction of Governor Holcomb, the Indiana State Department of Health (ISDH), and the Centers for Disease Control and Prevention (CDC).

Generally, you will be able to access INPRS resources and services as you usually would with some slight modifications to our operations:

- Our offices are now closed to the public. Our lobby is not open and our staff is not accessible for in-person interaction.

- Baseline applications should be faxed to us at (317) 974-1616. We will be unable to accept hard copies of baselines in our offices.

- ERM is up and running. All features are functional, and you can continue to submit wages and contributions, update member records, and all other functions that help you do your job.

- You can still reach our team by email at eppa@inprs.in.gov.

- Our Employer Pension Plan Administration (EPPA) representatives are available by phone, as usual, at (888) 876-2707. As we navigate this situation, you may experience delays. Thank you for your patience.

- At this time, we will not be conducting in-person visits with employers. We are confident we can help you using phone, email, and, if needed, video conferencing. We stand ready to assist you.

How we’re helping INPRS members

Effective immediately, INPRS is providing all group workshops and most individual counseling appointments via webinar and telephone.

These online workshops and phone appointments will offer the same information from the same INPRS’s team of expert Retirement Services Consultants. Members can register for these services on our website.

All communication regarding workshops and one-on-one appointments will be sent through email unless members do not have a valid email address on file. Members may also be contacted by phone or postal mail if there is sufficient time before their workshop or one-on-one appointment.

INPRS may provide face-to-face counseling using social distancing on a case-by-case basis for members who strongly prefer in-person counseling.

INPRS remains committed to providing members the full service they need to learn about and apply for the retirement benefits they've earned through years of public service.

Please encourage your employees to schedule time with one of INPRS’s Retirement Services Consultants as usual. During this challenging time, providing exceptional service to members while keeping them and our staff safe is our number one priority.

Additionally, we’ll be emailing our members information specific to how they can reach us during this time of adjustment. We’ll be sending you a copy of that communication when it goes out later today.

If members have questions, please have them contact us at 844-GO-INPRS or (844) 464-6777.

How we’re caring for our employees

We’ve made some workplace adjustments to help protect our employees, employers, and the community at large.

The vast majority of our staff members are working remotely. Work at the INPRS office is restricted to employees who have been designated as performing essential work that cannot otherwise be conducted remotely.

As mentioned, we have closed our downtown Indianapolis lobby to further protect our employees and guests. At this time, INPRS has no known exposure to the coronavirus.

We will continue to monitor the situation as it progresses and will look to the guidance provided by Governor Holcomb, the ISDH, and the CDC.

Thank you for your patience and understanding as we continue to serve you through these changes.

For more information about your pension and navigating to find specifics

For more information about your pension and navigating to find specifics