The employee exit process can be time-consuming. Let us make it easier for you. We’ve compiled a few of the most common questions that come up when employers are closing out recently terminated employee records.

Can I report my employee’s last day in pay (LDIP) during the termination process?

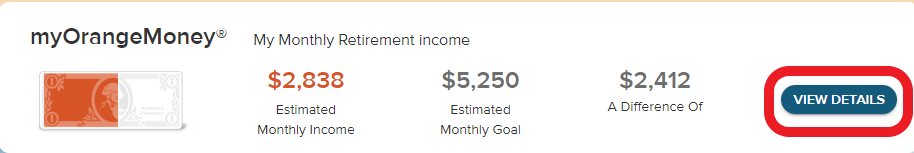

Yes, when it comes to reporting LDIPs, the sooner, the better! We request that our employers report LDIPs as soon as your employee leaves their position. If your employee is retiring or switching jobs, this process allows them to get access to their funds more quickly and saves you a call from us! You can even submit the LDIP and LCD information directly into ERM up to 60 days prior to the LCD.

What exactly is severance pay?

Severance pay is compensation paid to an employee when an employer terminates employment. Severance includes, but is not limited to, retirement bonuses and commutation of unused sick or personal leave. It is Indiana law to report your employee’s severance. To view Indiana’s regulations regarding severance, pay, click here.

Remember to submit severance pay in the appropriate fields on your wage and contribution file uploads. If this does not happen, a member’s annual salary is affected, resulting in a miscalculation of the member’s benefit. For a quick review on this step, refer to the ERM Wage and Contribution Manual along with our Employer Reporting and Maintenance (ERM) Wage and Contribution (W&C) File Layout Specification.

What is the difference between LDIP and the last check date?

LDIP stands for last day in pay, which is the last day the member physically worked for your unit, whereas the last check date represents the last check received by the member from the unit. Often, the last check date’s pay period range includes the last day in pay reported for the member.

Reporting this information late can result in members seeing a delay or a miscalculation of their retirement benefit. Following these guidelines will make your exiting process less of a hassle and speed up the process! If you have any questions about entering a termination life event into ERM, give our Employer Advocate team a call at (888) 876-2707.

All Funds: Automated LDIP/ LCD and Millie Morgan Notices

INPRS began sending automated LDIP/LCD requests on May 10th and Millie Morgan Retirement reminders on April 28th. The automated notifications for LDIP/LCD information will be sent 7 days prior to the members INPRS retirement date and again 10 days after the INPRS retirement date if the LDIP/LCD has not been submitted in the ERM system. If the LDIP/LCD information is not in ERM 15 days after the INPRS retirement date, the Employer Advocate Team will send requests with case numbers. The automated notifications will be sent to contacts in ERM with the following User Roles:

- Payment Administrator

- Wage and Contributions Administrator

- Life Event Administrator

Note: The INPRS retirement date is the 1st of the month following the members LDIP.

Millie Morgan notifications are sent via email once the application is submitted or 30 days prior to the retirement date, whichever occurs last. Unlike the LDIP and LCD requests, these notifications are not on a standard schedule. The Millie Morgan notices will indicate if the member has elected to continue member contributions or not. These notifications will also be automatically sent to the following User Roles:

- Payment Administrator

- Wage and Contributions Administrator

- Life Event Administrator

TR and PERF: Verify Substitute Teachers and Intermittent Annual Verification

The TRF annual verification of substitute teachers and non-TRF fund intermittent process has begun. For TRF, this is an annual process requiring employers to review their list of active substitute teachers in ERM.

Employers will update their substitute roster to reflect one of the following status changes for this school year:

- Active substitute teacher

- Promoted into a full-time position

- No longer working for the school corporation

For all other non-TRF employers, employers must verify the status of their intermittent employees.

For more information on this process and how to review your substitute or intermittent employees, check out pages 54-58 in the Member Management User Manual. These transactions will be placed in the Member Maintenance Exception Queue and will remain there until resolved. Please remember, employee records that are more than 30 days old will prohibit you from submitting further wage & contribution reports. Complete this annual to-do and maintain your ability to report your employees’ data to INPRS.

PERF and 1977 Fund Employers: Update on HEA 1104

House Enrolled Act (HEA) 1104 becomes effective 7/1/2024. How does HEA 1104 affect employers in relation to retirement fund options with INPRS? HEA 1104 allows School Resource Officers to join the 1977 Police Officers’ and Firefighters’ Retirement Fund (1977 Fund) if they meet certain conditions as described in HEA 1104, Indiana Code, and Indiana Administrative Code. Click here to go to HEA 1104 that details all the requirements to be eligible to participate in the 1977 Fund.

For additional information regarding the 1977 Fund feel free to visit the Indiana General Assembly’s website and go to chapter 8 of the Indiana Code for the 1977 Fund Police Officers’ and Firefighters’ Pension and Disability Fund here.

TRF Employers: ER Contribution Rate

On Friday, April 26th the INPRS Board approved an employer contribution rate of 6.5% for the TRF Hybrid and TRF My Choice plans effective January 1, 2025 through December 31, 2025. This new rate will be applied to all payroll dates that occur after January 1, 2025.

TRF Employers: Summer Logic Rules in ERM

Summer Logic rules in ERM state that from June 1st through August 31st all employers with the subunits type of School Districts and Education Employers, Charter School, and University will not receive a M90 error during this timeframe. During this summer break period, TRF and PERF members will not show up on the Missing Member Report.

Those already on the report as of May 31 will remain on the report – but “days missing” will not continue to accrue - until September 1. On September 1, the report will start adding members again, but will ignore the Summer Break Period.

The Missing Member Report will only look back to September 1 when calculating the number of days missing for all members in the new school year. No members will show up on the MMR until October 1, at the earliest.

NOTE: If the employer’s summer break will extend past 6/1-8/31, an alternate calendar should be created to eliminate M90 errors.

Upcoming INPRS Employer Events:

June 28 - 77' Fund Only: Pension Secretaries Conference in Plainfield

October - INPRS Employer Seminar in Indianapolis

For more information about your pension and navigating to find specifics

For more information about your pension and navigating to find specifics