Upcoming Benefit Payment Vendor Changes Retain Your Payment Preferences, Review Yours Now

On Jan. 2, 2024, our new benefit payment vendor, BNY Mellon, will assume responsibility for issuing payments to INPRS’s benefit recipients.

You’ll receive your monthly benefit payment on the same schedule as you always have, and in the same manner your benefits are currently paid. You’ll also log in to the same website as you always have at myINPRSretirement.org.

Here’s what you need to know:

- Where you currently access payment information, will no longer be available as of Dec. 29, 2023, by 5 p.m. EST. If you need to access documents or make changes for your 2023 1099s, address, or direct deposit information, do so before this date.

- You will be able to make updates for 2024 to this information and more starting Jan. 2, 2024, on the new site.

- If you receive your payment via direct deposit, your direct deposit information will be transferred to BNY Mellon, so there’s nothing you need to do to ensure your benefits arrive just as they always have.

- You’ll also receive an advice of deposit to your home address after your Jan. 2024 payment to confirm your information.

For more information, view our FAQs at https://bit.ly/BYNMFAQs.

Social Security Announces 3.2 Percent Benefit Increase for 2024

Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2 percent in 2024.

The 3.2 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 66 million Social Security beneficiaries in January 2024. Increased payments to approximately 7.5 million SSI recipients will begin on December 29, 2023. (Note: some people receive both Social Security and SSI benefits)

Read more about the Social Security Cost-of-Living adjustment for 2024.

Source: Social Security Administration

1099s arrive in January

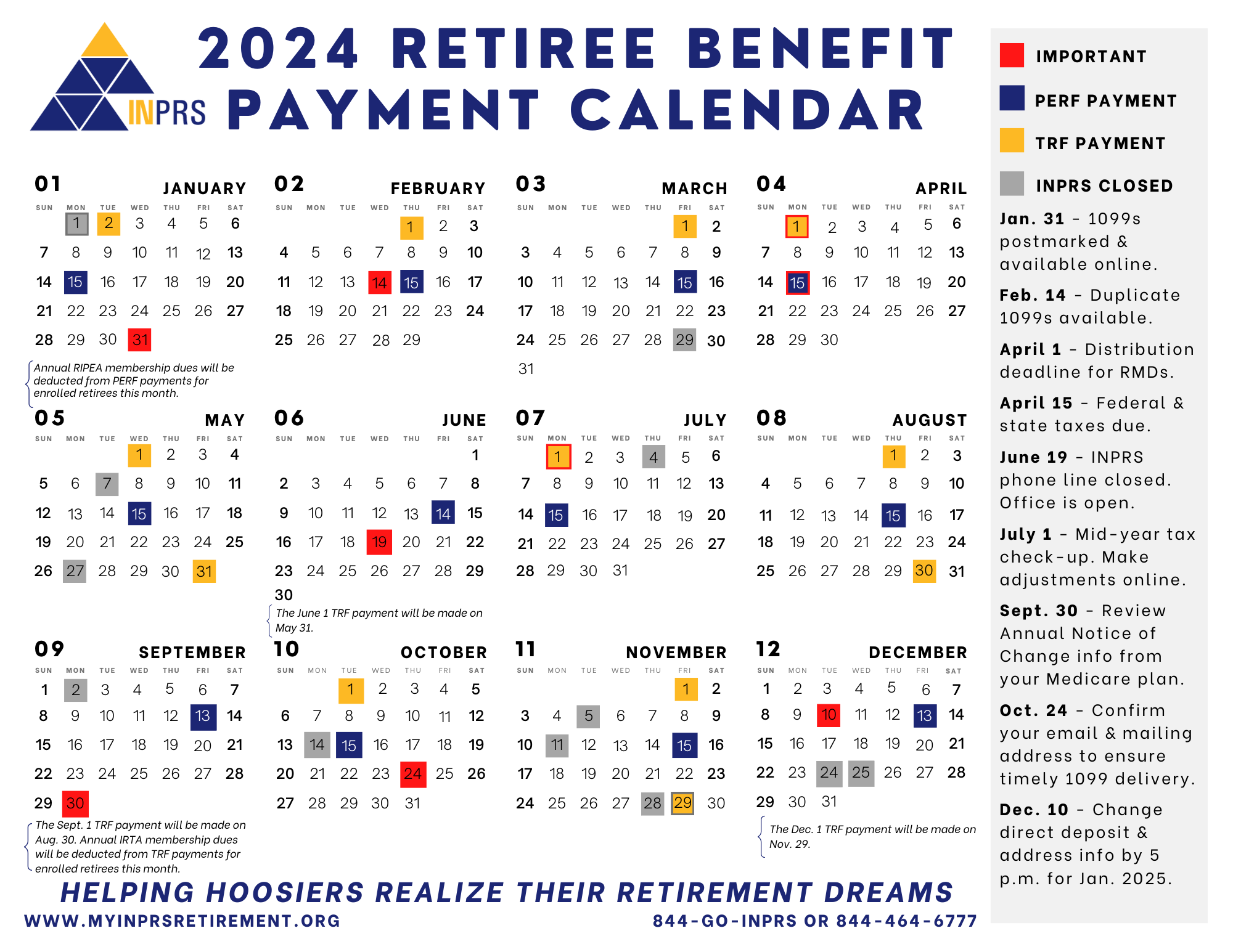

1099s will arrive in your mailbox and online any time after Jan. 31, 2024. Pay special attention to Box 7 of your 1099 to ensure it is appropriate for your situation. If the “early distribution-no known exception” box is checked and you believe there is an exception, please consult your tax advisor. Duplicate copies will be available after Feb. 14, 2024.

Updated Tax tables may impact your deposit

Your deposit may change in January due to updated IRS tax tables. When the tax tables are posted, we will send an email to retirees on our distribution list.

If you’re reading this newsletter in print, log on to your account and update your email address to be one of the first to know news and information about your INPRS retirement benefits.

For more information about your pension and navigating to find specifics

For more information about your pension and navigating to find specifics