Understanding the fees you pay

Paying fees may be the last thing that comes to mind when managing your finances, but it’s important to understand what fees you are paying, why and how often. When you review your statement, take note of the administrative and investment fees INPRS is required to add. We’re committed to only assessing the fees that are necessary for taking care of your account.

Below we sum up what you need to know about the two types of fees INPRS members pay: administrative fees and investment fees (also referred to as expense ratios):

ADMINISTRATIVE FEES

- PERF Hybrid, TRF Hybrid, and LE DC plan members pay administrative fees to cover the costs associated with managing their defined contribution (DC) accounts.

- Administrative fees are $3.75 deducted directly from members’ DC account each month, for an annual charge of $45. This deduction is noted on your quarterly member statement. PERF-and-TRF Hybrid members will find the fee noted on their annual member statement.

- Members of the PERF-and-TRF My Choice plans do not currently have an annual charge of $45.

- INPRS’s DC member fee policy outlines the method used to determine administrative fees. You can find the fee policy online.

EXPENSE RATIOS / INVESTMENT FEES

- INPRS's DC Plan investment options each carry an “expense ratio.” An expense ratio measures how much you’ll pay over the course of a year to own an investment option. An expense ratio is expressed as a percentage for each investment option.

- When you view your DC account, your online statement will show how much money you gained or lost, known as net of fees. All expenses are deducted from your investment option(s) before showing how much you gained or lost.

- For further details on Expense Ratios and to view the Fee table, click here.

You can use the below equation to figure how many dollars you’re paying annually in fees:

Amount Invested (dollars) x Expense Ratio (%) = Fee

For example: if you have $6,000 in a fund with an expense ratio of 0.10%, you’ll pay $6.00 per year in fees.

View your investment options and their associated expense ratios by logging into your secure online account at www.myINPRSretirement.org.

Becoming a financial superstar starts with your AMS

Finally, mail you want to receive

PERF-and-TRF Hybrid members who recently had a birthday will receive one of the most important documents you’ll see all year, your Annual Member Statement (AMS). Members will receive their statements a month following their birthday month.

This value-packed statement provides essential information you need to get a clear picture of where you stand with your retirement account. While PERF-and-TRF My Choice and Legislators' Defined Contribution Plan (LE DC) members do not receive an AMS, members can view their Quarterly Member Statements (QMS) to review important information and account balances.

Review this information carefully, as any discrepancies between the records we received from your employer and your hard-earned service credit may delay your future retirement plans. For PERF-and-TRF Hybrid members, gift future-you a smooth retirement application by letting us know of anything we’ve missed. Watch this short tutorial, where we go over login details and an example of submitting a completed application. PERF-and-TRF MyChoice plan members can log on to your secure account at www.myINPRSretirement.org and click on the “Retirement Application Center” for more details.

Give our Member Advocate Team a call at (844) GO-INPRS (464-6777) to initiate a service credit review. Our team will thoroughly research your service history and, if we find missed service, we’ll make corrections to make sure your qualified service credit counts. If your beneficiaries and contact information need updating, or you want to make changes to your investment selections, log on to your secure online account anytime.

This season, spend less while potentially earning more, invest in a retirement savings plan!

This season, spend less while potentially earning more, invest in a retirement savings plan!

It’s that time of year again – that time where people journey from store to store and spend hours online searching for the best deals on the hottest brands and destinations.

While buying new holiday-themed décor to adorn your home or snagging the perfect gift may be at the top of your list, don’t forget, you too deserve something special this time of year. And INPRS has just the idea, a gift that keeps on giving. A retirement savings plan!

Sure that may sound cheesy, but you know what, saving for retirement now-or anytime for that matter-is a lot less expensive than purchasing one of those novelty holiday cheese and meat trays for relatives you only see once in a blue moon. Let’s be honest, whether large or small, seasonal expenses on top of daily expenses can add up quickly. Before you know it, items owned or presents given can become plentiful, leaving your pockets empty.

That’s why a mindful budgeting and savings plan tailored to your unique situation and life expenses can help keep you on target toward the retirement of your dreams.

This season, why not add one of these items to you and your family’s wish list:

- A webinar, workshop, or one-on-one appointment with an INPRS retirement consultant. Register at https://bit.ly/RBWCalendar.

- An upgraded version of our myOrangeMoney® tool is available and can help you determine how much you might need for retirement. See how it works, here.

- Read about the 50/30/20 Rule and see if it can help you budget better and minimize expenses. Build a healthier budget.

- Our useful guides and resources are designed for your retirement readiness. Read more.

Whether you’re new to the idea of saving and budgeting, approaching the final leg of your career, or just need to modify your plan because life happens, we have you covered. INPRS’s team of retirement consultants can help you consider ways to spend less this holiday season while earning more.

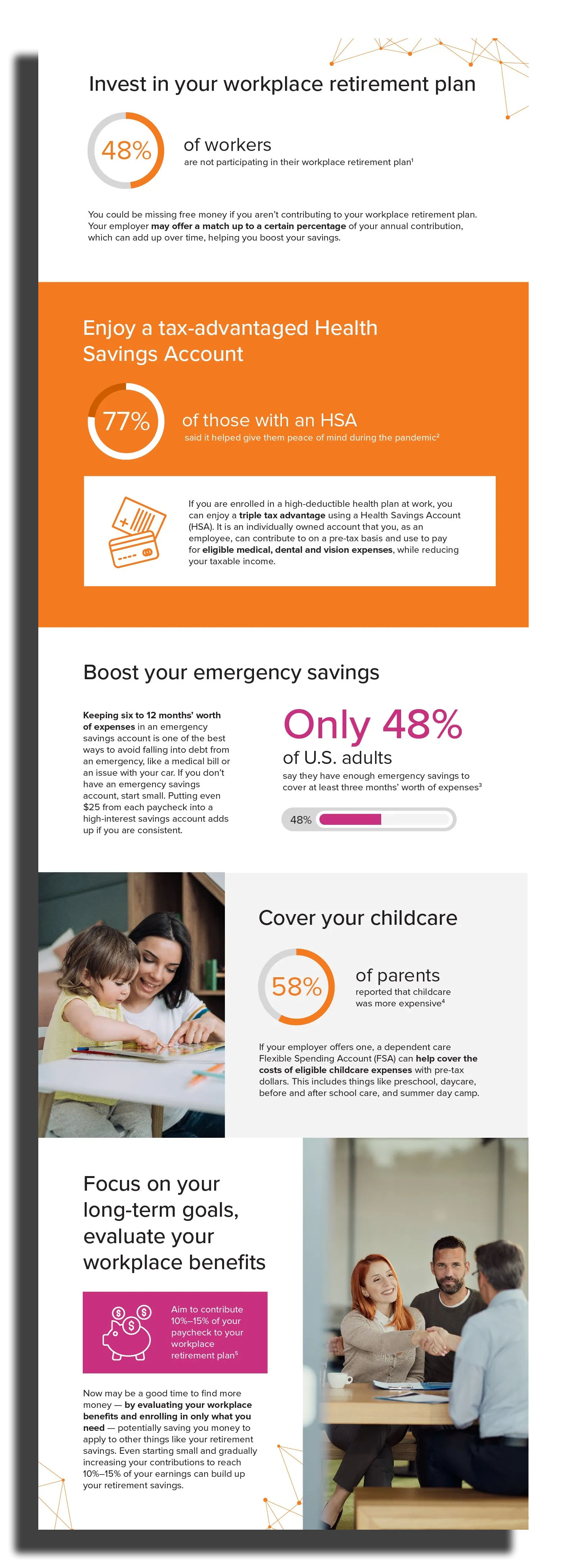

5 ways to invest in your future

The road to retirement is always changing, sometimes parts look familiar and other times the road is unknown. Regardless of your retirement journey, INPRS is by your side to navigate unforeseen obstacles. Our record-keeping partner, Voya, gives five ways you can invest in your future to avoid a bumpy ride and enjoy a smooth trip to retirement.

- If offered, ask your employer about investing in your workplace retirement plan and research alternative options.

- See if a tax-advantaged Health Savings Account (HSA) makes sense to cover you and your family’s health-related expenses.

- It’s never too early-or late-to boost your emergency savings.

- Have young children or planning to start? Ask your employer about childcare alternative coverage options.

- Focus on your long-term goals, evaluate your workplace benefits.

Source: Voya Financial

Federal student loan payments may resume, borrowers may be eligible for lower payments or loan forgiveness

In October, millions of federal student loan borrowers may have payments due on their loans for the first time since March 2020. Many borrowers may be able to reduce their payments or even get their loans canceled, and they should explore their options before making payments.

As borrowers prepare for student loan payments to resume, the Consumer Finance Protection Bureau (CFPB) is working to ensure that servicers follow the law and that consumers are protected. If you’re starting your student loan repayment in October, here’s what you need to know and what to do if you run into issues with your student loan servicers.

- Cancellation options are available.

- You may be able to reduce your monthly payments through income-driven repayment options.

- All borrowers should be automatically protected from certain consequences if they miss payments.

The CFPB has a number of tools for holding student loan servicers accountable, but consumer complaints are particularly powerful because they allow the CFPB to help consumers, identify and address emerging issues, and hold companies accountable for following the law. Borrowers who encounter issues with their student loans can submit a complaint with the CFPB, at https://www.consumerfinance.gov/complaint/.

Read more on how the CFPB will work on your behalf to make sure student loan servicers are follow the law, here.

Source: Consumer Finance Protection Bureau (CFPB)

10 simple steps to help protect yourself from fraud

10 simple steps to help protect yourself from fraud

International Fraud Week is November 12-18. As the ease of making financial transactions becomes second nature through a few easy clicks on a computer or smart device, criminals are finding new ways of committing fraud. Scam attempts that play on your emotions and seek to gain your trust are more frequent and more effective.

Vigilance is your best defense in protecting yourself. Read some simple tips you can follow to avoid the most common types of fraud from Voya, our record-keeping partner, here.

Source: Voya Financial