- About your self-directed DC investment options

Learn the basics about your DC account investment options with these easy-to-read fact sheets:

Investing 101 Fact Sheets

- What Are My Options for Directing My Defined Contribution Account?

- Powerful Options to Create a Well-Rounded Retirement

- What are Target Date Funds and which Target Date Funds are Offered at INPRS?

- What's the Expense Ratio?

Investment Fund Fact Sheets

- How should I invest in my DC account?

It's important to consider three things:

- Risk tolerance, or how comfortable you are with the account value rising and falling with the markets.

- Age, which may help determine risk tolerance. Younger members may be able to afford to take on more market risk since stock losses can be made up over time. Members closer to retirement may want to allocate more in stable value investments that provide regular income.

- Portfolio diversification: the concept of spreading contributions among different types of investments to reduce overall risk.

Please keep in mind that INPRS is unable to provide investment advice and recommends contacting a trusted financial advisor or planner.

More about risk tolerance

An investment's potential for loss at any given point in time is known as its risk. Risk tolerance is how comfortable you are with the account value rising and falling with the markets. If you cannot afford to lose money—even in the short term—you should consider less risky options (i.e. a stable value investment fund). If you are more concerned with growing your account value over time and keeping pace with inflation, you may want to invest in moderate to high-risk options (i.e. stock and bond funds). Small-company stocks tend to fluctuate more than large company stocks but have historically performed the best, and bonds vary less than stocks because of their steady stream of income. Over the long term, stock prices generally move up and provide higher returns than bonds or more stable investments

Take the Risk tolerance quiz.

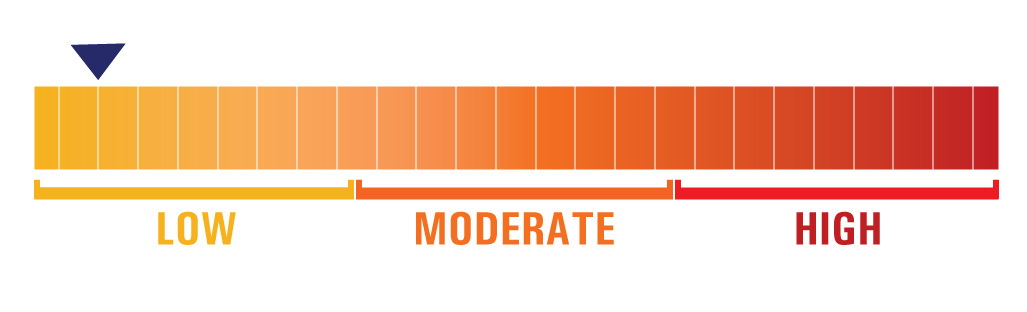

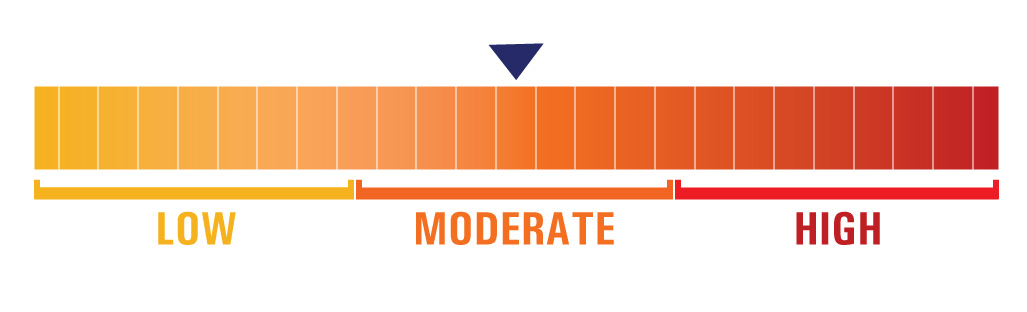

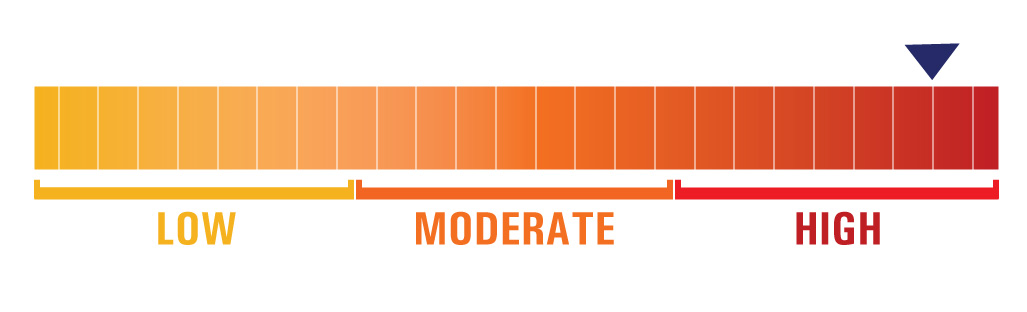

Risk levels

Funds are classified as having low risk levels if their share prices are expected to remain stable or to fluctuate only slightly. Such funds may be appropriate for the short-term reserves portion of a long-term investment portfolio, for investors with short-term investment horizons, or for investors with a conservative risk profile.

Funds are classified as having moderate risk levels if they are subject to a moderate degree of fluctuation in share prices. In general, such funds may be appropriate for investors who have a relatively long investment horizon or for investors with a moderate risk profile.

Funds are classified as having high risk levels if they are subject to extremely wide fluctuations in share price. These funds may be appropriate for investors who have a long-term investment horizon or for investors with an aggressive risk profile.

Check out this video about more investing terms you should know.

- About different types of investments

Learn about the difference between stocks, bonds, and commodities in this video:

Learn more about the various types of investments available, including stocks, bonds, money market funds, and CDs, in this article by our recordkeeper, Voya Financial®, called "Different Types of Investments."

Mutual Funds and ETFs: Why You May Want to Jump in the Pool

This article provides a more in-depth look at mutual funds and exchange-traded funds as types of investments.

Do you need more help finding out which types of retirement plans may work better for you? This article from Voya Financial®, "The Great Retirement Plan Showdown: Which One is Right For Me?" may give you the head start you need. Click here to check it out.

- Determining your DC allocation

Whether you are a member of the Public Employees' Retirement Fund (PERF) or Teachers' Retirement Fund (TRF), you can access your account online here. myINPRSretirement.org provides account management tools and educational resources for members, like this investing quiz. You can also learn more by reading the article "What Is Asset Allocation?" from, Voya Financial®, here.

You may have additional questions about how you should allocate your investments after reading this information. INPRS is unable to provide investment advice and recommends contacting a trusted financial advisor or planner. However, we have provided links to additional retirement and investment education resources below.

- Additional retirement planning and investment resources

General Information

Voya Financial Wellness

Investment Calculators

Retirement and Financial Education Calculators

More about INPRS Investments

Language Translation

For more information about your pension and navigating to find specifics

For more information about your pension and navigating to find specifics