Below you will find two real-world scenarios to help you have a sense of what the new benefit might look like. These will help you better understand the new changes and guide your own decision about your retirement.

- Scenario 1 - Jean: Take the Money Now or Wait?

Jean is 65 years old and has 20 years of service as of June 30, 2023. She's been planning to retire at age 67 and is looking forward to spending more time with her grandkids. However, she just learned about the new Millie Morgan eligibility rules and she's curious about what that could mean for her.

Her current salary is $50,000 and the average salary that INPRS will use for her pension is $45,000. If she applies for her pension now, she can increase her total income for the last two years that she was already planning on working if she goes ahead and selects the Millie Morgan retirement option. If she does, she’ll be collecting her pension and her regular paycheck from age 65 to 67, when she plans to retire completely. However, she's wondering if this will reduce her overall retirement income by taking her benefit earlier than expected and, if it does, by how much, and when she'd hit a break-even point when she compares taking her pension now or later.

She sat down with INPRS's retirement calculator and here's what she found:

If she takes her Millie Morgan retirement benefit now, she'll get $825 each month when she takes the straight life benefit. Annually, she'll earn $9,900 from her pension and, since she’s still working, her $50,000 salary.

When she retires at age 67, she'll leave her job and the salary that comes with it. However, she’ll have netted $19,800 more since she began collecting her benefit while she completed her final two years of work.

If she waits to take her pension when she retires at age 67, her monthly benefit will be $947.83, which accounts for two more years of service plus the increase in her average salary to $47,000 since she worked to age 67.

The difference between her pension benefit at age 67 compared to the amount it would be if she took it at age 65 is $122.83. If she takes her benefit at age 65, she earns $19,800 for the two years she's collecting and working. While her monthly benefit is $122.83 lower because she began collecting it earlier, it'll take approximately 13 years and five months for her to reach her break-even point.

Jean: Take the money now, or wait? Retire at age 65 and continue working until age 67 Retire at age 67 and stop working Pension Benefit while working (monthly/annually) $825/$9,900 $0 Salary earned year one $50,000 $50,000 Salary earned year two $50,000 $50,000 Total pension payments from age 65 to 67 $19,800 $0 Total earned from age 65 to 67 + monthly pension benefit $119,800 $100,000 Pension Benefit after stopping work (monthly/annually) $825/$9,900 $947.83/$11,373.96 Years to break even on $122.83/mo difference -- 13 years and five months ($19,800/$122.83 = 161.2 months or 13 years and five months) These scenarios assume no increase in annual wages, a Five-year Certain & Life pension, exclude taxes, and are for illustration purposes only. Please request a customized quote and consider your options with a trusted financial provider before making a life-changing financial decision.

- Scenario 2 - Howard: Take the money now, or let my average salary grow?

Howard is 66 years old and has 22 years of service as of June 30, 2023. He's been thinking about retiring, but he received a substantial compensation adjustment recently, so he's been reconsidering his plan.

Before his adjustment, he made $45,000 a year but for the past year, he's earned $60,000. His average salary is now $48,000, meaning that his pension benefit now would be $968. But, if he sticks around for two more years, his average salary would be at least $54,000 without considering any pay-for-performance increases.

He did the math with assistance from our calculator, and this is what he learned:

If he takes his pension benefit now under the new Millie Morgan rules, his monthly benefit would be $968. He's still considering working for a couple more years since his salary has improved so much. If he goes that route, he would be earning his $60,000 salary plus $11,616 through his pension each year.

If Howard decides to wait to retire until age 68, his average salary will grow thanks to his recently adjusted compensation. When he retires at age 68, he'll leave his job and begin to collect his pension, which will be $1,188 each month or $14,256 annually.

Howard's pension benefit will increase if he continues to work and waits to collect it until he retires and leaves his job. The additional two years of service plus the increased average salary make his pension benefit $220 more per month than it would be if he took the Millie Morgan retirement at age 66. However, the two years he'd be collecting his pension while working would add up to $23,232. If he waits to collect his $220 larger pension benefit at age 68, it will take eight years and nine months for Howard to reach his break-even point.

HOWARD: Take the money now, or let my average salary grow? Retire at age 66 and continue working until age 68 Retire at age 68 and stop working Pension Benefit while working (monthly/annually) $968/$11,616 $0 Salary earned year one $60,000 $60,000 Salary earned year two $60,000 $60,000 Total pension payments from age 66 to 68

$23,232 $0 Total earned from age 66 to 68 + monthly pension benefit

$143,232 $120,000 Pension Benefit after stopping work (monthly/annually)

$968/$11,616 $1,188/$14,256 Years to break even on $220/mo difference

-- Eight years and nine months ($23,232/$220 = 105.6 months or eight years and nine months) These scenarios assume no increase in annual wages, a Five-year Certain & Life pension, exclude taxes, and are for illustration purposes only. Please request a customized quote and consider your options with a trusted financial provider before making a life-changing financial decision.

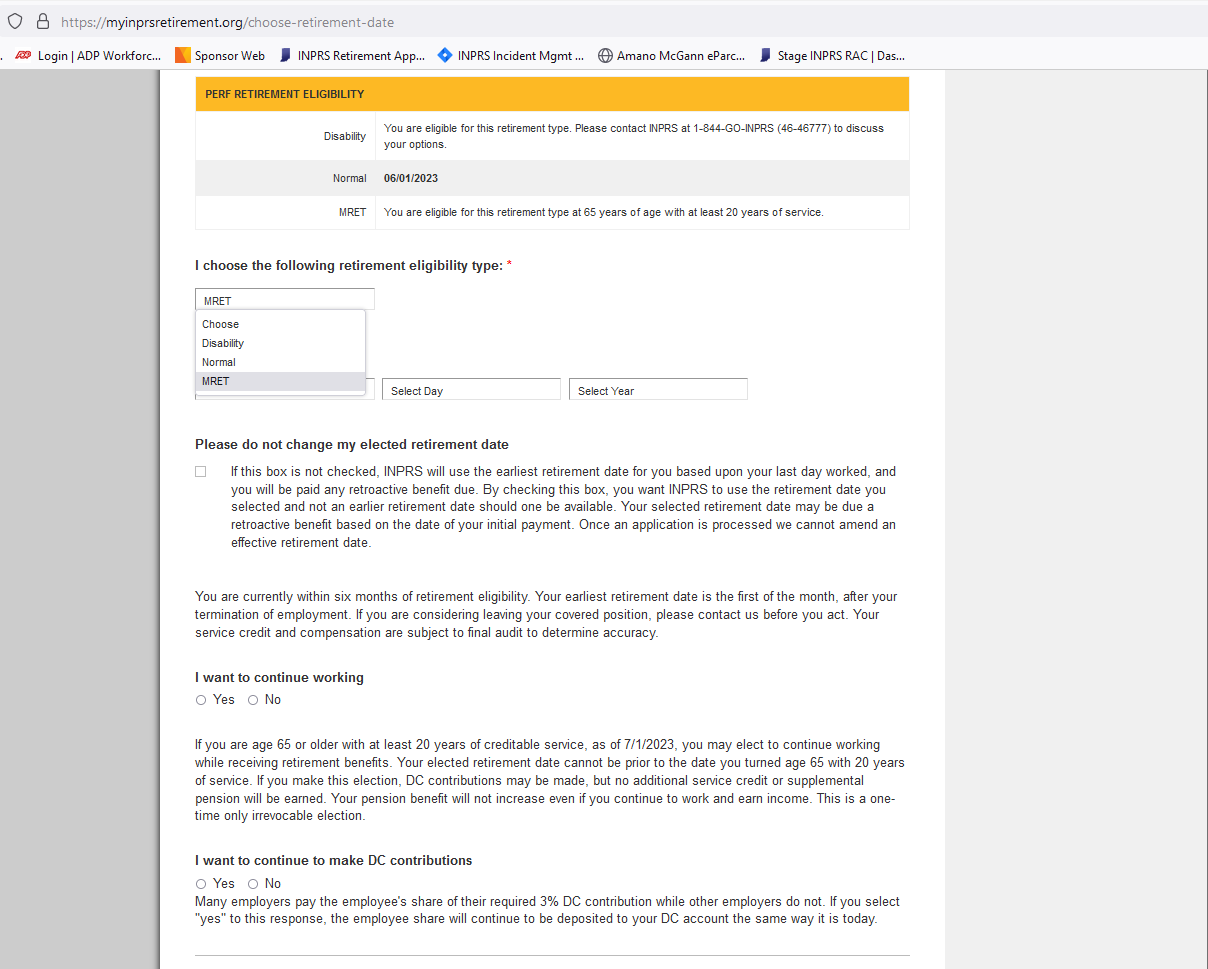

For more information about your pension and navigating to find specifics

For more information about your pension and navigating to find specifics