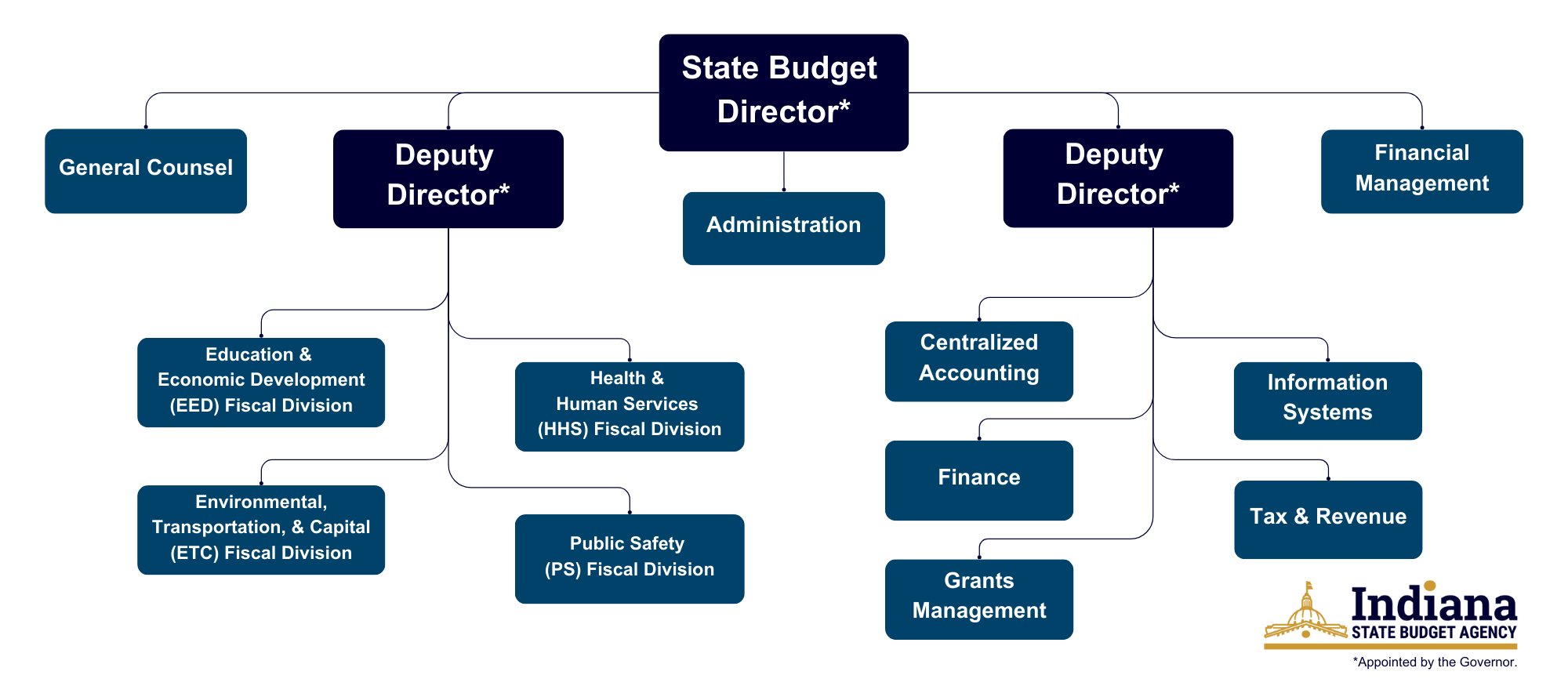

- Organization Chart

- Centralized Accounting

- Finance

- Fiscal Divisions

- Grants Management

- Information Systems

- Tax & Revenue

The Centralized Accounting Division was established in September 2009 for small agencies to drive efficiencies by reducing overall state costs of back-office expenses because services are pooled using fewer employees and standardized business processes across all business units. The Centralized Accounting Division operates as an internal service fund where it charges business units for accounting, payroll, contract creation, procurement services, and other back-office supports.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.

The SBA Division of Finance controls all appropriations in the state’s budget system. The Division processes budget appropriations approved in law and ensures that funds are recorded in the correct place in PeopleSoft. This includes managing all budget transfers, adding all federal funding sources, collecting data, and updating/writing queries.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.

SBA has four Fiscal Divisions, each led by a Division Director and staffed by a team of Fiscal Analysts. Our Fiscal Divisions are the engine of our State's financial management system. They work with portfolios of state agencies, performing all facets of financial management, including approving budget requests, managing spending plans, and reviewing federal grant applications.

Click here to learn more about our Fiscal Divisions

Please visit Current Budget and Historical Budget Information to learn more about how SBA manages Indiana’s biennial budget for the benefit of Hoosiers.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.

In any given year, roughly 50 percent of the funds spent in Indiana comes from the federal government. The Division of Federal Grants Policy and Management evaluates that federal funding, approves the pursuit of that funding, and trains agencies to effectively manage those funds. The Division supports SBA Fiscal Analysts’ review of federal grants and works with SBA’s Executive Team to integrate federal grants into Indiana’s financial management systems.

Grants management information and resources can be found on the Grants Management section of the website.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.

The SBA Information Systems (IS) Division maintains and supports all agency applications as well as applications that are deployed by the agency for statewide use, including Herald, Hyperion, PeopleSoft Financial Data, LOIT, and SPEED. During the budget development period, the IS Division is responsible for all data management of state agency budget submissions, including compiling all data requests into required legislative reporting and the final production of all appropriations for the state budget. The IS Division also acts as the first line of support for all users within the agency as well as the initial onboarding and offboarding of IT-related access and devices.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.

The Office of the Chief Economist and Tax Analysis (formerly known as Tax & Revenue division) completes key duties for the State Budget Agency. For instance:

- Chairs the State Revenue Forecast Technical Committee to deliver/present the State’s official consensus revenue forecast ($21B+ annually) used to determine the State’s official budget (December every year, April on odd-numbered years).

- Provide economic and revenue guidance throughout the year as needed.

- Advise on policy and project impacts and serve on task forces and other executive committees as needed (e.g., State and Local Tax Reform task force). The specific impacts that are determined by the Office of the Chief Economist are used to impact budgets (outside acts.)

- Oversee the $5B+ Local Income Tax administration process (e.g., includes revenue distributions to 92 counties, managing trust balance history reports).

- Perform other statutory duties with regards to calculations and reports (Rainy Day Fund, Maximum Levy Growth Quotient, As Passed Book etc.).

- Report and publish revenue reports and commentaries on a monthly basis.

- Develop and publish analysis, research, databases, and other publications.

The team works with various stakeholders outside of the State Budget Agency that include the OMB director, House/Senate senior fiscal analysts from both caucuses, the Legislative Services Agency, the Department of Revenue, Comptroller’s Office, Treasurer of State, Department of Local Government Finance, State Board of Accounts, Department of Transportation (and all departments as needed), technical leaders from academic institutions, local governments, regional and national associations.

Revenue Forecasts and Monthly Revenue Reports produced by the Office of the Chief Economist are available for review.

Questions? Please Contact Us.

Interested in joining our team? Please check-out our Employment Opportunities.